- Bitcoin gained 0.7% to reach $102,000 despite Middle East tensions escalating.

- Markets expect the conflict to end quickly, and prediction platforms show 92% odds of US-Iran diplomacy starting before July ends.

- Technical indicators suggest Bitcoin found strong support at $98,000 and may continue rising toward $104,000.

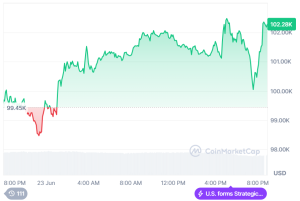

Bitcoin demonstrated resilience on June 23, climbing above $102,000 despite escalating Middle East tensions that initially threatened to trigger widespread market selloffs. The cryptocurrency gained 0.7% during Monday’s trading session, reversing earlier losses and surprising analysts who had anticipated further declines.

The digital asset found support near the $98,000 level, representing short-term holders’ cost basis. This technical floor provided the foundation for Bitcoin’s recovery, even as geopolitical risks intensified with increased US involvement in regional conflicts.

At the time of writing, Bitcoin is trading at $102,145.99, showing an increase of 2.58% over the past 24 hours.

Markets Signal Confidence in Swift Conflict Resolution

Traditional markets echoed Bitcoin’s optimistic sentiment, with stocks advancing while safe-haven assets like gold remained flat and oil prices declined by 1%. The Kobeissi Letter highlighted the unusual market dynamics, noting that oil prices fell from a 5% gain to a 0.2% decline despite Iran’s Parliament voting to potentially close the Strait of Hormuz, which controls 20% of global oil and gas flows.

Natural gas prices also retreated, dropping 1.1% as investors appeared to dismiss concerns about prolonged conflict. Even President Trump’s comments regarding potential government changes in Iran failed to drive demand for traditional safe-haven assets.

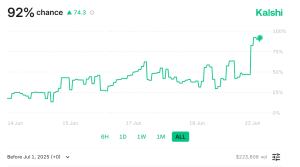

Prediction markets reinforced this sentiment, with Kalshi showing 92% odds that US-Iran diplomatic talks would commence before the end of July. This overwhelming confidence in rapid de-escalation helped stabilize risk assets across multiple sectors.

Technical Indicators Support Bullish Outlook

QCP Capital observed that elevated put skew through September coincided with strong spot price recovery and compressed volatility in near-term options. These technical signals suggested investors largely ignored broader contagion risks, treating the situation as a localized issue rather than a global threat.

The firm noted that US stock futures, oil, and gold initially reacted to geopolitical headlines but quickly returned to Friday’s closing levels. This pattern indicated that market participants viewed the tensions as a regional flashpoint unlikely to escalate into broader conflict.

Bitcoin traders identified several encouraging technical developments. Popular analyst Crypto Caesar expressed cautious optimism about the cryptocurrency’s price stability, while trader Merlijn pointed to a textbook inverse head-and-shoulders pattern forming on price charts.

The CME Group’s Bitcoin futures market created a significant gap during weekend trading, with approximately $4,000 in price differential. Trader Daan Crypto Trades noted that over half of this gap had already been filled, with the complete fill target at $103,600. Historical patterns suggest these gaps close within the first few days of the trading week, potentially supporting upward momentum toward $104,000.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.