- Bitcoin recovered to $105,041 after Trump announced an Israel-Iran ceasefire, and the price bounce suggests strong institutional demand remains intact.

- Mining hashrate dropped 8% during the conflict, but experts say such fluctuations are normal, while traders now expect Federal Reserve rate cuts by November.

At the time of writing, Bitcoin is trading at $105,292, following a volatile weekend that saw prices drop below $98,500 for the first time in 45 days. The cryptocurrency’s recovery came after President Donald Trump announced a comprehensive ceasefire agreement between Israel and Iran, calming investor concerns about regional conflict escalation.

The digital asset’s price action triggered significant market movements. Leveraged positions worth $193 million were liquidated during the downturn, representing 0.3% of total futures open interest. Despite this liquidation event, the overall derivatives market showed resilience with $68 billion in leveraged positions remaining stable compared to Saturday’s levels.

Bitcoin’s 4.4% decline over 12 hours falls within normal volatility parameters. Similar price drops occurred thrice in the past month, suggesting the current movement represents typical market behavior rather than fundamental weakness.

Mining Operations Face Regional Disruptions

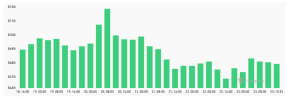

Bitcoin’s network hashrate experienced notable fluctuations during the geopolitical uncertainty. The mining difficulty metric dropped 8% between Sunday and Thursday, falling from 943.6 million terahashes per second to 865.1 million TH/s.

Industry observers speculated about potential mining disruptions in Iran, where unauthorized operations allegedly consume up to 2 gigawatts of electricity. However, verification of these claims remains challenging due to limited transparency in regional mining data.

Experts emphasized that hashrate variations occur regularly for multiple reasons. Daniel Batten highlighted how weather events frequently impact mining operations, particularly in the United States. A notable example occurred on April 22 when severe storms in Texas and Oklahoma caused a 27% hashrate decline. The weather system included heavy rainfall, large hail, and 17 confirmed tornadoes that disrupted local power grids.

No this is not because Iran is secretly mining large swathes of Bitcoin using nuclear energy. Firstly, drops like this are common (see chart below) and are more likely due to ERCOT curtailment (being paid to shed load, or getting a price signal it’s uneconomical to mine).… https://t.co/AxX3poncZ6 pic.twitter.com/XnL4YGaMCl

— Daniel Batten (@DSBatten) June 23, 2025

Federal Reserve Policy Expectations Shift

Financial markets responded positively to de-escalation news, with oil prices retreating from Sunday’s $77 peak. The S&P 500 index gained 1% as commodity pressures eased.

Interest rate expectations underwent significant revision following developments in Qatar. CME Group’s FedWatch tool indicates reduced confidence in the Federal Reserve maintaining current 4.25% rates through November. The probability dropped to 8.4% from 17.1% the previous week.

Traders now assign 53% odds to rates falling to 3.75% or lower by November, up from 38% seven days earlier. This shift reflects growing expectations that geopolitical stability could enable more accommodative monetary policy.

Despite global uncertainties, Bitcoin’s swift return above $100,000 demonstrates sustained institutional interest. The recovery suggests underlying demand remains robust, though analysts caution against assuming immediate price targets based solely on Middle East developments.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.