- Bitcoin faces a potential fourth straight summer loss while the S&P 500 prepares for its third consecutive seasonal rally.

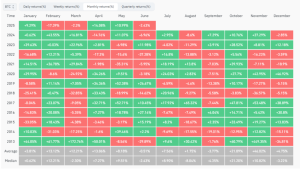

- Since 2020, Bitcoin has posted only one positive June performance compared to the S&P 500’s two negative Junes during the same period.

- Bitcoin’s summer struggles come from crypto-specific events like mining bans and halving cycles, but traditional markets show better resilience during challenging periods.

At the time of writing, Bitcoin is trading at $107,129, showing an increase of 1.78%, as the cryptocurrency approaches another challenging summer. The digital asset risks extending its losing streak to four consecutive summers if current trends continue through August 2025. This pattern contrasts sharply with the S&P 500, which appears positioned for its third straight seasonal rally.

Market data reveals a growing divergence between cryptocurrency and traditional equity performance during the summer. Since 2020, the S&P 500 has delivered eight positive performances across July and August combined. Bitcoin managed six positive months during the same timeframe. The gap widens significantly when June’s performance is examined specifically.

Bitcoin has recorded just one positive June since 2020, while the S&P 500 suffered only two negative June periods over the identical span. This divergence highlights the distinct factors driving each asset class during summer trading.

Crypto-Specific Catalysts Drive Summer Volatility

Bitcoin’s summer struggles stem from cryptocurrency-native events rather than seasonal trading patterns. Major disruptions have included China’s mining prohibition, halving cycle effects, and post-pandemic inflation pressures. These factors have created unique volatility windows that traditional markets typically avoid.

The 2020 summer began with Bitcoin dropping 3.18% in June despite breaking above $10,000 following the COVID-19 recovery. The DeFi Summer phenomenon later boosted the cryptocurrency alongside global stimulus measures and a zero-interest rate policy.

China’s regulatory crackdown dominated the 2021 summer performance. Mining bans and trading restrictions in May created significant network disruption. Bitcoin recovered in July through institutional interest led by prominent figures, including Elon Musk and Jack Dorsey. The summer concluded with Bitcoin posting 8.68% gains – its final positive summer performance.

The 2022 period marked Bitcoin’s worst summer on record. The Terra ecosystem’s collapse in May triggered widespread contagion across blockchain markets. Celsius faced liquidity crises while Three Arrows Capital collapsed entirely. Regulatory setbacks included the SEC denying Grayscale’s Bitcoin ETF conversion application.

Concurrent macroeconomic pressure intensified selling. US inflation reached 40-year highs at 9.1%, prompting aggressive Federal Reserve rate increases. Consumer sentiment plummeted to record lows as markets braced for disappointing earnings results.

Traditional Markets Show Greater Resilience

The S&P 500 demonstrated superior recovery capabilities during challenging periods. July 2022 delivered the index’s strongest July performance since 2013, rising over 9% despite crypto market turmoil. Big Tech earnings exceeded expectations, providing crucial support for equity valuations.

Federal Reserve communications consistently impacted both asset classes. Jerome Powell’s Jackson Hole speeches have repeatedly dampened market optimism, particularly his 2022 commitment to continued tightening policies.

Bitcoin briefly outperformed in June 2023, gaining 12% on ETF application momentum. BlackRock’s involvement generated particular excitement given the firm’s exceptional ETF approval record. However, both assets finished August 2023 in negative territory following renewed Fed hawkishness and China’s Evergrande bankruptcy.

The 2024 summer highlighted ongoing challenges for Bitcoin. Weak ETF inflows, post-halving miner selling, and yen carry-trade unwinding pressured prices lower. Meanwhile, the S&P 500 benefited from AI optimism and Nvidia-led technology gains.

Market Integration Creates New Dynamics

Bitcoin’s increasing integration with traditional finance introduces complex dynamics. ETF products, corporate treasury adoption, and institutional flows have strengthened correlations with equity markets. However, cryptocurrency-specific events continue generating disproportionate volatility.

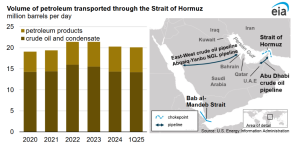

Current geopolitical tensions add uncertainty to the outlook for summer 2025. US-Iran conflicts threaten oil supply routes through the Strait of Hormuz. Escalating Middle East tensions could drive inflation higher, impacting risk asset sentiment broadly.

Bitcoin remains uniquely vulnerable to internal market shocks despite growing mainstream adoption. Unlike equities driven by earnings and rate expectations, cryptocurrency markets still respond dramatically to sector-specific catalysts.

The “sell in May” strategy proves less reliable across asset classes as market structures evolve. Even with institutional maturation, Bitcoin’s most severe downturns typically originate from cryptocurrency-native developments rather than broader market conditions.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.