- Grayscale added Avalanche and Morpho to its Q3 2025 Top 20 crypto list while removing Lido DAO and Optimism due to regulatory concerns and weak economic value capture.

- XRP and Cardano remain excluded from the list despite their high market caps and trading volumes, showing Grayscale’s strict evaluation criteria.

- The firm launched an AI crypto index tracking 24 tokens worth $15 billion, with Bittensor leading the category as institutional interest in AI blockchain projects grows.

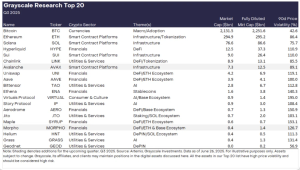

Asset management giant Grayscale Investments has released its quarterly Top 20 cryptocurrency list for the third quarter of 2025. The updated selection introduces significant changes that reflect shifting market dynamics and institutional priorities. Avalanche (AVAX) and Morpho (MORPHO) join the list as new additions, while Lido DAO (LDO) and Optimism (OP) were removed from the previous quarter’s lineup.

The quarterly reshuffle demonstrates Grayscale’s evolving assessment criteria for digital assets. The firm evaluated tokens based on fundamental growth indicators, recent performance metrics, and adoption trends across various cryptocurrency sectors. This strategic approach aims to identify assets with the strongest potential for the upcoming quarter.

New Additions Drive Growth Focus

Avalanche secured its position following increased user activity and substantial stablecoin flows on its network. The layer-1 blockchain has experienced growing institutional adoption and developer activity throughout 2025. Its inclusion reflects the platform’s expanding ecosystem, competitive transaction speed, and cost efficiency advantages.

Morpho’s addition highlights the increasing institutional interest in decentralized finance protocols. The lending platform has established itself as a significant player in the DeFi space. Morpho currently ranks second in DeFi lending by total value locked, supported by strong revenue generation and the successful launch of Morpho V2. The protocol’s focus on bringing DeFi services to traditional financial institutions aligns with broader market trends toward institutional adoption.

Removing Lido DAO and Optimism from the Top 20 reflects specific sector challenges. Lido was removed amid regulatory concerns that could weaken demand for liquid staking services. Regulatory uncertainty surrounding staking services has created headwinds for the protocol’s fee revenue potential. This decision signals Grayscale’s cautious approach to regulatory risk factors.

Optimism’s exclusion demonstrates the firm’s emphasis on economic value capture over technology adoption alone. Despite widespread use of Optimism’s scaling technology, the token faced challenges translating network growth into sustainable economic returns for holders.

The continued absence of XRP and Cardano (ADA) from the list remains notable given their market capitalizations and trading volumes. Both projects maintain active development ecosystems and significant community support. However, their exclusion suggests Grayscale prioritizes different fundamental metrics in its evaluation process.

Sector Trends and Market Outlook

Grayscale’s Q3 report also covers broader market developments from the second quarter of 2025. Bitcoin demonstrated superior performance within the Currencies category compared to other digital assets. Smart Contract Platforms experienced increased transaction volumes but faced declining fee revenues as memecoin activity moderated across networks.

The firm has launched its Artificial Intelligence Crypto Sector index, which tracks 24 tokens representing a combined market value of $15 billion. Based on the index methodology, the AI crypto sector gained 10% in Q2 2025. Bittensor (TAO) leads this emerging category, reflecting growing institutional interest in AI-focused blockchain projects.

These developments indicate evolving investment priorities within the cryptocurrency ecosystem. Institutions increasingly focus on protocols with clear utility and sustainable revenue models rather than speculative momentum alone. Grayscale’s updated list provides insight into which projects meet these evolving standards for institutional consideration.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.