- Shiba Inu dropped 11% in June and continues falling in July, with trading volumes shrinking to $94 million.

- Whale transactions fell 24 times lower than the June level, and network activity on Shibarium declined significantly.

- Technical analysis shows a bearish pattern that could lead to a 40% crash to $0.00000634.

Shiba Inu (SHIB) continues its downward trajectory in July 2025, extending losses that began in June when the meme coin shed over 11% of its value. The token currently trades at $0.0000113 with daily trading volumes contracted to $94 million, raising concerns among investors about the cryptocurrency’s near-term prospects.Analysts point to five critical factors driving SHIB’s decline: reduced whale activity, diminishing network engagement, falling active addresses, poor meme coin sector performance, and decreased futures market interest. These converging forces create a challenging environment for recovery as traders reassess their positions in the volatile meme coin market.The cryptocurrency’s technical indicators suggest additional downside pressure, with chart patterns pointing toward a potential 40% correction. This bearish outlook reflects broader sentiment shifts in the digital asset space as investors migrate toward more established cryptocurrencies.

Whale Activity Reaches Critical Low Point

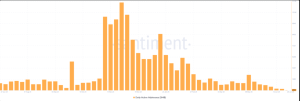

Large-scale investor participation has dropped dramatically, creating significant pressure on SHIB’s price. IntoTheBlock data reveals that transactions exceeding $100,000 have fallen to 1.09 trillion tokens, representing a 24-fold decrease from June’s peak of 24 trillion tokens.

This whale’s inactivity removes a crucial source of buying pressure that historically supported price movements. The token lacks the volume necessary to sustain upward momentum without substantial institutional or high-net-worth individual participation. The absence of these major players typically signals reduced confidence in short-term price appreciation.

Whale behavior often serves as a leading indicator for broader market sentiment. Their reluctance to engage suggests deeper concerns about SHIB’s fundamental value proposition and growth prospects in the current market environment.

Shibarium network activity has experienced a substantial decline, with total value locked (TVL) dropping from $6.44 million in December 2024 to $1.78 million. This 72% reduction in locked assets indicates waning developer and user interest in the ecosystem’s decentralized finance applications.

The network’s declining usage directly impacts SHIB’s burn mechanism, reducing the rate at which tokens are permanently removed from circulation. Lower burn rates mean reduced deflationary pressure, removing a key catalyst that previously supported price appreciation.

Active address metrics present equally troubling data. Weekly active addresses have reached a one-year low of 2,902, demonstrating significantly reduced retail participation. This metric serves as a proxy for genuine user adoption and engagement, making its decline particularly concerning for long-term sustainability.

Reduced network activity and falling user engagement suggest fundamental weaknesses in SHIB’s utility and ecosystem development. These metrics often precede extended price downturns, reflecting actual usage rather than speculative trading activity.

Broader Market Headwinds Intensify Pressure

The meme coin sector has faced substantial selling pressure, with total market capitalization falling from $64 billion to $52 billion over the past month. This 19% sector-wide decline indicates that SHIB’s struggles reflect broader investor sentiment rather than token-specific issues.

Futures market data from Coinglass shows reduced trader interest, with open interest declining by over $140 million in two months. This reduction in derivatives activity suggests that professional traders avoid SHIB positions, viewing the risk-reward profile as unfavorable.

The shift in trader preferences favors Bitcoin and other established cryptocurrencies. Some analysts predict Bitcoin could reach $200,000, drawing capital away from speculative assets like meme coins.

Technical analysis reveals a rounded top pattern formation, typically indicating sustained bearish momentum. The pattern suggests a potential decline to $0.00000634, representing a 40% drop from current levels. The Relative Strength Index remains near 50, confirming ongoing bearish momentum.

However, some indicators provide modest optimism. The Awesome Oscillator shows green histograms, suggesting potential weakening of selling pressure. This development could temporarily pause the downtrend, though broader fundamental challenges remain unresolved.

Reduced whale activity, declining network metrics, sector-wide weakness, and bearish technical patterns create a challenging environment for SHIB recovery. Without significant improvements in these areas, further price declines appear probable in the coming weeks.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.