- The Rex Shares Solana Staking ETF launched with $33 million in trading volume and $12 million in inflows on day one.

- SOL price jumped 4.3% and CME futures volume hit an all-time high after the ETF debut.

- A Bloomberg analyst expects the fund’s assets to grow from $1 million to $10 million soon.

The REX-Osprey Solana Staking ETF (SSK) achieved remarkable success on its debut trading day, recording $33 million in trading volume. The fund attracted $12 million in inflows and reached $1 million in assets under management within 24 hours of launch.

Bloomberg ETF strategist Eric Balchunas highlighted the impressive performance, noting that SSK outperformed both the XRP and SOL futures ETF launches. The trading volume exceeded typical ETF debut metrics by significant margins.

Balchunas expressed optimism about the fund’s trajectory, suggesting assets under management could reach $10 million in the coming days. He attributed this projection to sustained investor interest and strong initial market response.

Market Response Drives Solana Price Higher

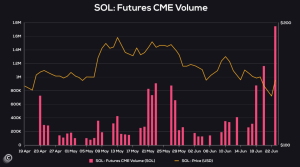

Solana’s native token, SOL, experienced a 4.3% price increase following the ETF launch announcement. The positive market sentiment pushed daily trading volume to $4 billion, reflecting heightened investor activity.

CME futures trading volume for SOL reached an all-time high, surpassing $1.7 million. This milestone demonstrates growing institutional interest in Solana derivatives products.

Market analysts project potential upward momentum for SOL, with some forecasting a 47% price increase to $235. However, the token faces immediate resistance at the $159 level, which traders monitor closely.

Regulatory Landscape Favors Spot ETF Approvals

The successful staking ETF launch positions Solana favorably for future spot ETF approvals. Thirteen issuers currently await SEC approval for spot Solana ETF products.

Balchunas previously assigned 95% approval odds for spot Solana ETFs, rating them higher than spot XRP ETF prospects. This assessment reflects the regulatory environment’s evolving stance toward cryptocurrency investment products.

The crypto ETF market continues expanding, with XRP, SOL, ADA, and LTC generating the strongest investor demand. These altcoins represent the next wave of potential ETF products beyond Bitcoin and Ethereum.

The launch timing coincides with increased institutional adoption of digital assets. Traditional finance firms are exploring cryptocurrency exposure through regulated investment products.

SSK’s strong debut performance may encourage other asset managers to accelerate their cryptocurrency ETF development timelines. The market response demonstrates sustained appetite for innovative crypto investment products.

Solana’s ecosystem continues to benefit from institutional recognition and investment product development. The staking ETF represents another milestone in the blockchain’s mainstream adoption journey.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.