- Metaplanet bought 2,204 Bitcoin for $237 million and now holds 15,555 total Bitcoin.

- The company became the fifth-largest corporate Bitcoin holder and passed Tesla’s holdings.

- Market analysts warn that new companies entering the Bitcoin treasury space may struggle because the best opportunities have already passed.

Japan’s leading corporate Bitcoin treasury company, Metaplanet, has completed another significant cryptocurrency acquisition. According to a Monday filing, the company purchased 2,204 Bitcoin for $237 million.

The acquisition occurred at an average price of 15,640,253 Japanese yen per Bitcoin, equivalent to approximately $107,700. This purchase increases Metaplanet’s total Bitcoin holdings to 15,555 BTC. The company’s average purchase price across all acquisitions is $99,985 per Bitcoin.

Metaplanet Climbs Corporate Bitcoin Rankings

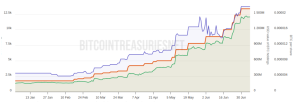

BitcoinTreasuries.NET data shows Metaplanet now ranks as the fifth-largest corporate Bitcoin holder globally. The company surpassed Tesla’s holdings in late June after acquiring 1,234 BTC, bringing its total to 12,345 BTC. Tesla currently holds 11,509 BTC.

Metaplanet also exceeded Bitcoin mining company CleanSpark’s holdings of 12,502 BTC through a separate purchase. The company bought 1,005 BTC for $108 million on June 30, strengthening its position among corporate Bitcoin holders.

Corporate Bitcoin Strategy Faces Growing Scrutiny

The corporate Bitcoin treasury trend continues expanding across multiple sectors. Strategy, the world’s largest corporate Bitcoin holder, acquired 4,980 for $531.1 million on June 30. This purchase brought the company’s total holdings to 597,325 BTC, valued at approximately $42.4 billion with an average price of $70,982 per coin.

Recent corporate entries include ProCap, which purchased 3,724 BTC for $386 million in late June. Healthcare technology company Semler Scientific announced plans to increase its holdings from 3,808 Bitcoin to 105,000 Bitcoin.

However, market analysts express concerns about the sustainability of this strategy. Glassnode lead analyst James Check suggested the Bitcoin treasury approach may lack long-term viability for new entrants. He warned that companies entering the space now might have missed the optimal entry point.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.