- XRP captured 22% of Upbit’s daily trading volume and jumped 72% in 24-hour activity, while other cryptocurrencies declined.

- Ripple CEO Brad Garlinghouse will testify before the U.S. Senate Banking Committee, and the company filed for a national banking license.

- Technical analysts spot an inverse head-and-shoulders pattern that could push the XRP price if confirmed.

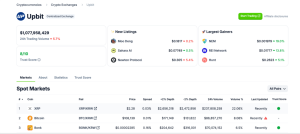

XRP has captured 22% of daily trading volume on Upbit, South Korea’s premier cryptocurrency exchange, generating approximately $1.22 billion in transactions out of the platform’s total $4.53 billion volume. The surge represents a 72% increase in XRP’s 24-hour trading activity, positioning the cryptocurrency as a standout performer while broader cryptocurrency markets experience minor corrections.

The token climbed roughly 2% during this period, defying the modest pullbacks across most altcoins. South Korean investors have historically demonstrated a strong preference for XRP over Bitcoin and other major cryptocurrencies, with this trend continuing across the country’s four primary exchanges: Upbit, Bithumb, Korbit, and Coinone.

Regulatory Developments Drive Investor Confidence

Ripple CEO Brad Garlinghouse’s upcoming testimony before the U.S. Senate Banking Committee on cryptocurrency market structure legislation has strengthened investor sentiment. The invitation signals the growing acceptance of blockchain technology among American lawmakers and represents a significant milestone for Ripple’s regulatory positioning.

The company has simultaneously filed for a national banking license with the U.S. Office of the Comptroller of the Currency (OCC), indicating plans for deeper integration into traditional financial systems. These regulatory advances have renewed institutional interest in XRP and its underlying technology.

Market observers note that improved regulatory clarity in the United States could accelerate institutional adoption of XRP for cross-border payments and other financial applications. Regulatory progress and expanding global partnerships position Ripple for potential market share growth.

Technical Analysis Points to Potential Breakout

Cryptocurrency analyst Ali Charts has identified a possible inverse head-and-shoulders pattern on XRP’s price chart, suggesting a potential breakout to $2.6. This technical formation typically indicates the conclusion of a downtrend and the beginning of upward momentum.

The pattern’s emergence coincides with increased trading activity from South Korean exchanges, where XRP maintains strong retail and institutional support. Technical indicators suggest the token may be approaching a critical resistance level that could trigger significant price movement.

Market data shows XRP’s trading volume has outpaced most major cryptocurrencies, with South Korean exchanges accounting for a substantial portion of global activity. The sustained interest from Korean investors has historically preceded broader market rallies for the digital asset.

XRP’s dominance in South Korean trading markets and positive regulatory developments in the United States create a foundation for sustained growth. The token’s performance contrasts sharply with the broader cryptocurrency market’s recent consolidation phase.

Ripple’s strategic focus on regulatory compliance and traditional finance integration may attract additional institutional investors seeking compliant crypto. The company’s banking license application and the CEO’s Senate testimony represent concrete steps toward mainstream financial adoption.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.