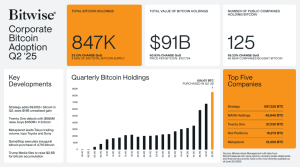

- Corporate Bitcoin holdings surged 18% in Q2 2025 as public companies outpaced ETFs in Bitcoin purchases for the third consecutive quarter, with companies now holding 4% of the total Bitcoin supply.

- Strategy leads with 597,325 BTC and raised its 2025 yield target to 25%, while traditional companies like GameStop joined the movement by adding Bitcoin as a treasury reserve asset.

- Public companies acquired 131,000 Bitcoin in Q2 versus ETFs’ 111,000, marking a fundamental shift in how corporations view Bitcoin as a legitimate treasury asset and inflation hedge.

The corporate Bitcoin accumulation trend has accelerated dramatically in 2025, with the second quarter marking a watershed moment for institutional adoption. Public companies acquired about 131,000 coins in the second quarter, growing their bitcoin balance by 18%, while Bitcoin ETFs showed slower growth at 8% during the same period.

This shift represents a fundamental change in how corporations view Bitcoin as a treasury asset. The quarter’s performance has solidified Bitcoin’s position as a legitimate corporate reserve asset, with companies now holding approximately 4% of Bitcoin’s total supply.

Strategy Leads Corporate Bitcoin Revolution

Strategy continues to top corporate holdings with 597,325 BTC, followed by Mara Holdings with 49,940 BTC. The company, formerly known as MicroStrategy, has transformed from a software firm into what founder Michael Saylor calls a “Bitcoin Treasury Company.”

The strategy’s aggressive accumulation strategy has yielded remarkable returns. The company’s conviction-driven approach has delivered substantial gains throughout 2025, with its stock significantly outperforming traditional market indices. The company announced a new $21 billion at-the-market (ATM) common stock equity offering and increased its 2025 “BTC Yield” target from 15% to 25%.

The firm’s Bitcoin holdings represent a massive portion of its market value, with about 581,000 bitcoins, worth around $63 billion, which is significantly higher than its annual software revenue of about $463 million. This demonstrates the complete strategic pivot toward Bitcoin as the company’s primary value driver.

Traditional Companies Join the Movement

The most significant development has been the entry of non-crypto-native companies into the Bitcoin treasury space. GameStop will follow in the footsteps of software company MicroStrategy, now known as Strategy, which bought billions of dollars of bitcoin in recent years. GameStop’s announcement to add Bitcoin as a treasury reserve asset caused its shares to surge 12%.

Other notable entrants include Trump Media, which filed to raise $2.5 billion for Bitcoin accumulation, and various international companies expanding their digital asset strategies. Metaplanet has emerged as a dominant force in Japan, accumulating significant Bitcoin holdings while generating substantial trading volume on Tokyo exchanges.

The corporate Bitcoin adoption trend has created a new dynamic in the cryptocurrency market. Public companies bought more bitcoin than ETFs for the third quarter in a row, indicating sustained institutional demand beyond traditional investment vehicles.

This corporate accumulation strategy has several implications for the broader market. Companies increasingly view Bitcoin as a hedge against inflation and currency devaluation, while also seeking to capitalize on potential long-term appreciation. Favorable regulatory developments and growing mainstream acceptance of cryptocurrency as a legitimate asset class have supported the trend.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.