- SharpLink Gaming bought 31,487 ETH worth $90 million, and its stock jumped 63% in one week.

- BlackRock’s Ethereum ETF pulled in $761 million this week and now holds over 2 million ETH.

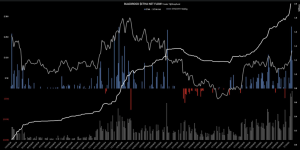

- The institutional buying pushed Ethereum up 15%, and future open interest hit $41 billion.

The corporate race for Ethereum accumulation has reached new heights as major institutional players aggressively secure significant ETH positions. This week marked a turning point in institutional crypto adoption, with multiple companies announcing substantial treasury strategies.

SharpLink Gaming Emerges as Ethereum’s New Corporate Champion

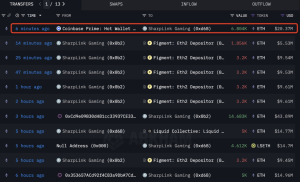

SharpLink Gaming (NASDAQ: SBET) has positioned itself as a major player in the Ethereum treasury space by acquiring 31,487 ETH worth approximately $90 million. The gaming company’s stock price surged 17% on Friday, extending its weekly gains to an impressive 63%.

The company’s strategic move began with an agreement to purchase 10,000 ETH from the Ethereum Foundation. However, SharpLink Gaming expanded its position significantly by acquiring an additional 21,487 ETH valued at $64.26 million through over-the-counter transactions on Coinbase Prime.

These acquisitions have brought SharpLink Gaming’s total Ethereum holdings to 237,121 ETH. According to Yahoo Finance data, the aggressive buying strategy has attracted considerable investor attention, with daily trading volumes reaching $53 million.

The company’s approach mirrors Strategy’s Bitcoin treasury strategy, positioning SharpLink Gaming as a potential leader in corporate Ethereum adoption. GameSquare, another Nasdaq-listed entity, has followed suit by announcing its $100 million Ethereum treasury strategy.

BlackRock Dominates with Massive ETF Inflows

BlackRock’s iShares Ethereum ETF (ETHA) has captured significant market attention with $761 million weekly inflows. The world’s largest asset manager recorded $137 million daily inflows on Friday alone, acquiring 45,696 ETH from the open market.

The ETF’s performance has been remarkable, with total holdings reaching 2.045 million ETH and assets under management climbing to $6.15 billion. According to Trader T data, Friday marked another milestone as ETHA achieved $1 billion in daily trading volume.

BlackRock’s institutional involvement has strengthened market confidence in Ethereum’s long-term prospects. The asset manager’s entry into the Ethereum treasury race alongside corporate players has created a competitive environment for ETH accumulation.

The institutional buying pressure has increased Ethereum prices by 15% over the past week. ETH trades near the critical $3,000 resistance level, with market analysts expressing optimism about further price appreciation.

Derivatives markets have also responded to the increased institutional interest. ETH’s future open interest has surged to $41 billion, reflecting growing institutional participation and potential for continued price momentum.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.