- BitMEX co-founder Arthur Hayes bought $1.5 million worth of ENA tokens during a price dip and used multiple exchanges to complete the purchase.

- Ethena recently listed on Upbit, South Korea’s largest crypto exchange, and the announcement caused the ENA price to jump 20%.

- ENA currently trades at $0.3371, but some analysts believe it could reach $1.

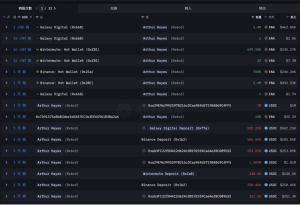

Arthur Hayes, co-founder of BitMEX, has invested significantly in Ethena (ENA) tokens worth $1.505 million. During a recent price dip, the cryptocurrency veteran executed multiple transactions across major platforms to accumulate approximately 4.2 million ENA tokens.

On-chain analyst @EmberCN tracked Hayes’ wallet activity, revealing strategic purchases through different exchanges. The investment occurred as ENA experienced a temporary decline, with Hayes buying tokens at approximately $0.22 before the price recovered to $0.33.

Strategic Multi-Platform Acquisition

Hayes distributed his ENA purchases across three major platforms to complete the substantial acquisition. The former BitMEX executive transferred 755,000 USDC to Binance, converting it to 2.1 million ENA tokens.

Another transaction involved sending 248,000 USDC to Wintermute, which yielded 700,000 ENA tokens. The third major transaction saw Hayes transfer 502,000 USDC to Galaxy Digital, producing 1.4 million ENA tokens.

These coordinated purchases demonstrate Hayes’s confidence in Ethena’s potential. The timing coincided with his recent predictions about a “monster altseason” led by Ethereum, suggesting his ENA investment aligns with broader market expectations.

Upbit Listing Drives Market Interest

Hayes’ investment follows Ethena’s listing on Upbit, South Korea’s largest cryptocurrency exchange. The listing announcement triggered immediate market response, with ENA prices surging 20% shortly after the news broke.

Hayes acknowledged the significance of the Korean market entry, stating on social media that the Upbit listing represented “time for liftoff.” The exchange commands an 81% market share in South Korea, providing substantial exposure for ENA tokens.

Ethena’s synthetic dollar platform positions it uniquely in the decentralized finance sector. Research analysts project the platform could generate over one billion dollars in revenue, supported by its dominant market position and limited competition.

ENA reached a daily high of $0.37 following the Upbit listing before settling at current levels. The token trades at $0.3371 as of press time, representing a 7.4% decline from recent peaks. However, weekly performance shows strong growth of 32%.

Trading volume has decreased by 54% to $518 million over 24 hours, indicating some market consolidation. Despite short-term volatility, ENA maintains upward momentum from its recent lows.

Traders remain optimistic about ENA’s trajectory. Price predictions suggest potential movement toward $0.4526016 in the near term. Some experts project the token could exceed $1.00, though such targets depend on broader market conditions and continued adoption.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.