- Bitcoin reached a new all-time high of $118,700, and the total crypto market hit $3.66 trillion.

- Bitcoin and Ethereum ETFs saw massive inflows of $2.4 billion and $900 million after the SEC guidance streamlined approval processes.

- The US House declared July 14 “Crypto Week” and will vote on three major cryptocurrency bills that could shape future regulations.

The cryptocurrency market has reached a historic milestone, with total market capitalization hitting $3.66 trillion and daily trading volume exceeding $163 billion. This surge represents a dramatic shift from late June performance, driven by institutional adoption and regulatory clarity.

Bitcoin shattered previous records this week, establishing multiple all-time highs that culminated in a peak of $118,700 on July 11. The digital asset initially broke through the $112,000 barrier on July 9, fueled by expectations of Federal Reserve interest rate cuts.

The momentum continued as Bitcoin reached $113,000 on July 10 before setting its current record. Ethereum followed suit, crossing the $3,000 threshold on July 11, while altcoins experienced significant gains amid speculation of an approaching altcoin season.

ETF Inflows Drive Market Momentum

Exchange-traded fund activity played a crucial role in the market rally. The Securities and Exchange Commission released a 13-page guidance document on July 7, clarifying disclosure requirements for crypto ETFs and reducing approval timelines by 75 days.

Bitcoin ETF inflows reached $2.4 billion during the week, while Ethereum ETF products attracted $900 million in fresh capital. This institutional interest underscores growing confidence in cryptocurrency as a legitimate asset class.

Major institutional players contributed to the buying pressure. Japan’s Metaplanet secured its position as the fifth-largest Bitcoin holder globally, adding 2,205 BTC to its reserves. Cryptocurrency whales withdrew 220 million ETH from exchanges, signaling strong conviction in the market’s direction.

Notable whale activity included a fresh wallet withdrawing 32,566 ETH worth $89.3 million from Kraken, while Abraxas Capital pulled 29,741 ETH valued at $81 million from Binance and Kraken. Meanwhile, Bit Digital sold 280 BTC and pivoted to Ethereum investments.

Regulatory Developments Shape Market Outlook

The U.S. House of Representatives designated July 14 as “Crypto Week,” scheduling votes on three significant cryptocurrency bills. The CLARITY Act addresses regulatory clarity, the GENIUS Act focuses on stablecoin frameworks, and the Anti-CBDC Surveillance State Act opposes central bank digital currencies.

These legislative initiatives could establish clearer regulatory guidelines for cryptocurrency, potentially reducing market uncertainty and encouraging broader adoption.

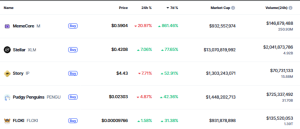

Memecore emerged as the week’s biggest winner, surging over 800% to trade at $0.59 with a market cap approaching $1 billion. Stellar claimed second place with a 77% weekly gain, currently trading at $4.10.

Pudgy Penguin posted a 43% weekly increase to $0.023, while FLOKI registered a 30% rally. Among major cryptocurrencies, XRP led with a 25% surge, outperforming Bitcoin’s 9% gain during the same period.

The top five cryptocurrencies, excluding Tether, posted gains exceeding 5%, reflecting broad-based market strength. This performance suggests sustained investor confidence despite recent volatility concerns related to trade policy announcements.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.