- Bitcoin dropped $7,000 this week, but institutions bought more instead of selling.

- US Bitcoin ETFs are buying Bitcoin faster than miners can produce it, creating a supply shortage.

- Due to strong institutional demand, analysts predict Bitcoin could reach $130,000 to $135,000 within six months.

Bitcoin institutional investors demonstrated unprecedented resilience this week as BTC price action briefly dipped below $116,000 on Tuesday. Despite the sharp correction, large-volume investors increased their positions rather than fleeing the market.

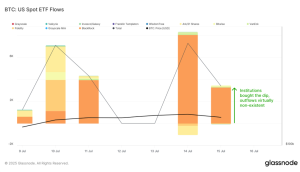

Data from onchain analytics firm Glassnode reveals a fundamental shift in institutional behavior. The $7,000 price drop that would have triggered massive outflows in previous months instead sparked aggressive buying from professional investors.

ETF Inflows Remain Strong During Market Volatility

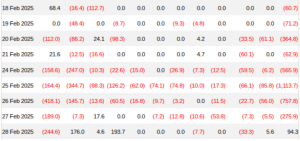

US spot Bitcoin exchange-traded funds recorded exceptional inflows throughout the correction period. Monday witnessed one of the largest daily inflows in three months, with institutions adding 7,500 BTC to their positions.

Tuesday’s response proved even more significant. Rather than panic-selling during the price decline, institutions doubled their commitment by purchasing an additional 3,400 BTC. Outflows remained minimal across all major Bitcoin ETFs.

This behavior marks a stark contrast to earlier market corrections. In late February, when Bitcoin dropped from near $100,000 to $75,000, net outflows exceeded $3.2 billion over eight trading days. The selloff included the largest-ever daily net outflow of over $1.1 billion.

Supply Deficit Creates Bullish Price Dynamics

Network economist Timothy Peterson highlighted a critical supply-demand imbalance emerging from ETF activity. US Bitcoin ETFs are acquiring Bitcoin faster than the network can produce new coins through mining rewards.

The fixed supply schedule, which halves Bitcoin production every four years, has created a net deficit of 343,000 Bitcoin from ETF acquisitions alone. This represents approximately $40 billion in current market value.

Peterson’s analysis suggests the supply shortage could drive significant price appreciation. His projections indicate that BTC could gain another $18,000 by year-end, assuming that steady institutional demand continues without major supply increases from miners or long-term holders.

The economist’s six-month forecast projects Bitcoin could reach $130,000 to $135,000, barring major market disruptions. These projections assume consistent ETF inflows and no significant supply releases from existing Bitcoin holders.

The institutional response to this week’s volatility suggests a maturing market where professional investors view price dips as buying opportunities rather than exit signals. This behavioral shift could reduce Bitcoin’s historical volatility while supporting higher price floors.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.