- Ethereum gained $150 billion in market value since July, triggering a massive short squeeze that wiped out billions in leveraged positions.

- Bitmine Technologies now holds over 300,000 ETH worth $1 billion and plans to acquire 5% of Ethereum’s total supply.

- BlackRock’s Ethereum ETF saw $544 million in daily inflows, and the company filed for staking approval with the SEC.

Ethereum has experienced a remarkable surge over the past two months, adding more than $150 billion to its market capitalization since early July. The crypto trades at $3,601, marking a 4.99% increase over the past 24 hours as institutional demand reaches unprecedented levels.

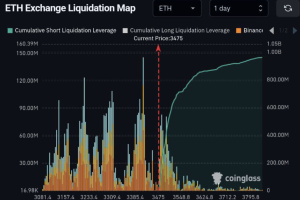

The rally has triggered a historic short squeeze, with net leveraged short positions reaching record highs before the price reversal. Short sellers faced billions in liquidations as ETH climbed over 50% in under a month. Market analysts suggest another 10% price increase to $4,000 could eliminate an additional $1 billion in short positions.

Corporate Giants Build Strategic ETH Reserves

Public companies are aggressively accumulating Ethereum as part of their treasury strategies. Bitmine Technologies (NYSE: BMNR) has emerged as the largest corporate ETH holder, surpassing SharpLink Gaming (NASDAQ: SBET) and pushing the Ethereum Foundation to third place.

Tech billionaire Peter Thiel’s $500 million investment in Tom Lee’s Bitmine has accelerated the company’s pivot toward building strategic ETH reserves. Bitmine now holds over 300,000 ETH, valued at over $1 billion. The company has set an ambitious target of acquiring and staking 5% of Ethereum’s total supply, representing approximately $20 billion at current market prices.

SharpLink Gaming continues expanding its Ethereum portfolio, adding 18,711 ETH worth $65 million to its holdings. The gaming company announced plans to raise $5 billion in new funding for further ETH acquisitions.

BlackRock Files for Staking Approval

BlackRock iShares Ethereum Trust (ETHA) recorded its largest single-day inflow of $544 million on Thursday. The asset management giant simultaneously filed for staking approval with the U.S. Securities and Exchange Commission, signaling deeper institutional involvement in Ethereum’s ecosystem.

BlackRock’s ETHA has accumulated over $7.6 billion in net inflows since inception, with more than $3 billion entering during the past two months. The broader U.S. ETF market has seen combined inflows exceeding $7.1 billion across all issuers.

ETH’s future open interest has surged past $51.27 billion, reflecting increased institutional participation and market confidence. Corporate treasury accumulation, ETF inflows, and short squeeze dynamics have created a powerful momentum that is driving Ethereum’s price higher.

Traders closely monitor whether this institutional adoption trend will sustain Ethereum’s rally beyond current levels. The race for Ethereum treasury positions among public companies suggests corporate America is positioning for long-term exposure to the world’s second-largest cryptocurrency.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.