- Robert Kiyosaki warns that financial bubbles may soon burst and Bitcoin could crash.

- He says any gold, silver, or Bitcoin crash is a buying opportunity.

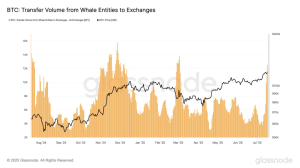

- Whales and miners are moving more BTC to exchanges while institutions keep buying.

Veteran investor Robert Kiyosaki has issued a cautionary statement, warning that several economic bubbles in the U.S. are nearing their breaking point. According to Kiyosaki, these looming busts will likely impact key assets, including Bitcoin.

Bitcoin recently hit a record high of $123,000. However, the price has since dropped to around $118,000 as long-term holders take profits. Kiyosaki, a long-time advocate of Bitcoin, maintains that this dip should be viewed as a buying opportunity, not a red flag.

Macroeconomic Pressures Mount

The U.S. national debt has reached $37 trillion, and Treasury yields continue to rise. June’s CPI data also shows that inflation remains sticky. Kiyosaki believes these conditions are unsustainable and expects sharp corrections across major asset classes.

In a recent post, he stated, “If gold, silver, and Bitcoin prices crash… I will be buying.” His remarks reflect ongoing uncertainty in traditional markets and the growing fragility of U.S. financial stability.

On-chain data supports the view of a near-term correction. Glassnode reports that whale-to-exchange BTC transfers are nearing 12,000 BTC on a 7-day simple moving average, one of the highest levels in 2025. This metric mirrors behavior last seen in late November, often signaling profit taking and capital reallocation.

Bitcoin miners also send more coins to exchanges, a typical indicator of potential price drops. Combined with rising whale activity, these moves suggest short-term selling pressure could continue.

Despite increased exchange inflows, institutional interest in Bitcoin remains robust. Last week alone, 21 firms added $810 million worth of BTC to their treasuries. Spot Bitcoin ETFs also recorded strong inflows, reflecting consistent demand from corporate and institutional investors.

As market volatility grows, traders watch closely for signs of deeper corrections or new buying windows.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.