- World Liberty Financial bought 3,473 ETH for $13 million, bringing its total holdings to 73,616 ETH.

- The platform’s average ETH purchase price is $3,272, with over $33 million in unrealized profit.

- Ethereum price rose 2% after the buy as institutional and whale interest in ETH grows.

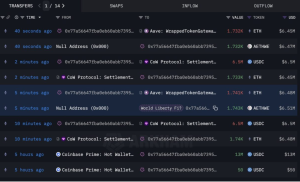

World Liberty Financial, a crypto platform linked to the Trump family, has made another major Ethereum purchase. The project swapped $13 million in USDC to acquire 3,473 ETH at an average price of $3,743 per token, according to on-chain data from Lookonchain. This new addition raises WLF’s total Ethereum holdings to 73,616 ETH, valued at approximately $275 million.

The average purchase price across these accumulations now stands at $3,272. With Ethereum’s recent gains, World Liberty Financial currently holds an unrealized profit of over $33 million.

This move follows last week’s $10 million ETH buy, which netted 3,007 ETH at $3,325 per coin. In May, the project also acquired 1,587 ETH for $3.5 million. These consistent purchases suggest a long-term strategy and confidence in Ethereum’s performance.

Ethereum Price Reacts to Whale Activity

The latest ETH acquisition has coincided with a short-term price rally. Ethereum gained 2% in the past 24 hours and reached a daily high of $3,763. Over the last seven days, ETH is up 20%, with a monthly growth of 67%.

Large-scale Ethereum buying by platforms like World Liberty Financial can impact liquidity and overall market sentiment. The timing of these purchases aligns with rising institutional interest, which continues to shape the current crypto cycle.

Institutional Ethereum Interest Grows

WLF is not alone in accumulating Ethereum. Recent acquisitions by SharpLink Gaming and Bitmine signal a broader trend among major players. One of the largest asset managers globally, BlackRock, is also reportedly expanding its interest in Ethereum-based products.

In parallel, Ether Machine, a $1.6 billion project backed by Archetype, Blockchain.com, Pantera Capital, Electric Capital, and Kraken, is entering the scene. The platform has further amplified Ethereum’s profile as a top institutional-grade asset.

Meanwhile, Ethereum whales are becoming more active. One early ICO-era wallet, dormant for nearly a decade, recently moved 1 ETH, bringing attention to the $2.44 million in unrealized profit still held in the address.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.