- ENA tokens jumped 15% as USDe stablecoin became the third-largest with a $9.3 billion market cap.

- Ethena protocol now ranks sixth in DeFi with over $9.47 billion total value locked and strong revenue growth.

- Investors should watch for volatility from $101.87 million in token unlocks this week.

Ethena’s native token ENA has gained 15% in 24 hours, pushing its price above $0.61 as the protocol’s USDe stablecoin achieves significant market milestones. The rally comes amid strong institutional demand and expanding DeFi adoption across the Ethereum ecosystem.

USDe Stablecoin Reaches $9.3 Billion Market Cap

USDe has experienced explosive growth, with its supply increasing 75% over the past month to reach $9.3 billion, according to DeFiLlama data. This surge has propelled USDe past FDUSD to secure the third-largest stablecoin position by market capitalization, trailing only Tether (USDT) and USD Coin (USDC).

Following the passage of the GENIUS Act, the synthetic dollar protocol recently announced plans for a USD-compliant stablecoin. This development has strengthened investor confidence in Ethena’s regulatory positioning and long-term growth prospects.

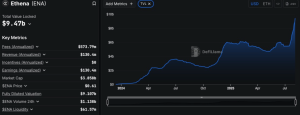

Ethena’s DeFi protocol has climbed to sixth place with total value locked (TVL) exceeding $9.47 billion. High yields and strategic integrations continue attracting risk-seeking DeFi users and conservative stakers to the platform.

Despite recent selling pressure, ENA has delivered impressive returns, gaining 140% over the past month. Today’s 15% recovery has restored bullish sentiment among traders, with daily trading volume increasing 20% to surpass $1.1 billion.

CoinGape’s ENA price prediction suggests the altcoin could reach $0.70 within the next month, supported by continued ecosystem expansion and stablecoin adoption.

July marked a breakthrough month for Ethena, recording $2.96 billion in USD inflows compared to just $47 million in June. Platform fees jumped to $36.5 million in July from $19.96 million the previous month, demonstrating robust revenue generation.

Token Unlocks Present Near-Term Volatility Risk

Despite today’s rally, investors face potential headwinds from $101.87 million in ENA token unlocks scheduled this week. CryptoRank data shows Ethena has the largest token unlock event among major cryptocurrencies, which could introduce selling pressure.

Market activity suggests profit-taking behavior among early investors. Crypto analyst Ali Martinez reported that 250 million ENA tokens moved to exchanges over the past two weeks. Veteran investor Arthur Hayes recently sold 7.76 million ENA coins worth $4.62 million, highlighting institutional profit realization.

The combination of strong fundamental growth and upcoming token unlocks creates a mixed outlook for ENA’s short-term price action. While USDe’s market position and protocol TVL support long-term bullish sentiment, traders should prepare for increased volatility as unlocked tokens enter circulation.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.