- BlackRock sold 490 BTC worth $68.7 million, and Ark Invest sold 559 BTC for $64.4 million amid market concerns.

- Veteran traders predict Bitcoin will drop below $100,000 in September before recovering to new highs.

- Other companies, like Strategy and Metaplanet, bought Bitcoin during the price decline while major holders took profits.

BlackRock and Cathie Wood’s Ark Invest have executed significant Bitcoin selloffs amid ongoing market turbulence. The moves come as veteran traders predict further price corrections below the $100,000 threshold.

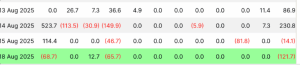

BlackRock liquidated 490 BTC valued at $68.7 million while selling $87.2 million of Ethereum. The asset management giant maintains substantial exposure with 749,500 BTC remaining in its portfolio. The selloff coincided with BlackRock’s spot Bitcoin ETF (IBIT) achieving record assets under management exceeding $91 billion.

Source: Farside Investors

Ark Invest followed suit by disposing of 559 BTC through its Ark 21Shares Bitcoin ETF, generating approximately $64.4 million. The transaction represents part of the broader negative ETF flows recorded throughout August.

Market Predictions Signal Further Decline

Veteran trader Dr. Profit strongly believed Bitcoin would drop below $100,000 in September. The analyst anticipates a recovery to new all-time highs in subsequent months following the correction.

Bull Theory supports this bearish outlook, projecting a decline toward $98,000 support levels. However, the analyst maintains optimistic long-term expectations, targeting $160,000-$200,000 within six months if bulls successfully defend critical price zones.

Source: X

Despite recent selloffs, Wood maintains her bullish stance on Bitcoin’s trajectory. She previously predicted Bitcoin could reach $1.5 million based on increasing corporate and institutional adoption. Wood believes growing institutional participation will reduce volatility while establishing Bitcoin as a stable investment vehicle.

Strategic Accumulation Amid Price Weakness

Several entities capitalized on the recent price decline through strategic acquisitions. Strategy expanded its Bitcoin holdings by purchasing 430 BTC for $51.4 million. Japan’s Metaplanet acquired 775 BTC, bringing its total holdings to 18,888 BTC.

Metaplanet’s aggressive accumulation strategy has resulted in a BTC rating of 18.67x, enhancing the company’s resistance to market volatility. These purchases demonstrate institutional confidence despite short-term price pressures.

The contrasting approaches highlight different market perspectives. While BlackRock and Ark Invest secure profits through strategic sales, other institutional players view current prices as attractive entry points.

Bitcoin’s near-term direction depends on market liquidity restoration and the bulls’ ability to maintain the $109,000-$112,000 support range. Exchange liquidity levels and institutional buying patterns will determine whether recent corrections represent temporary profit-taking or the beginning of extended bearish momentum.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.