- Hyperliquid generated a record $106 million in August revenue, and the HYPE token reached a new all-time high of $51.17.

- The platform’s buyback fund grew from 3 million to 29.8 million HYPE tokens and is now worth over $1.5 billion.

- Hyperliquid processes $8 billion daily, becoming the second-largest Bitcoin spot trading platform globally.

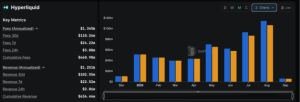

Hyperliquid posted its strongest monthly performance in August, generating $106 million in revenue according to DefiLlama data. The decentralized derivatives platform saw a 23% increase from July’s $86.6 million figure, driven by nearly $400 billion in perpetual trading volume.

Source: DefiLlama Data; Hyperliquid Fees and Revenue Chart

The revenue surge coincided with HYPE token reaching a new all-time high of $51.17, marking a significant milestone for the protocol. Trading activity on the platform has intensified, with daily volumes exceeding $8 billion through its fully on-chain trading system.

Revenue Growth Fuels Token Buyback Program

Hyperliquid channels a substantial portion of its earnings into an Assistance Fund that automatically purchases HYPE tokens from the open market. The fund’s holdings have expanded dramatically from 3 million tokens in January to 29.8 million, now valued at over $1.5 billion.

The protocol’s Layer-1 blockchain, HyperEVM, powers this growth through high throughput and low-cost transactions. Unlike traditional platforms, Hyperliquid eliminates off-chain oracles and order matching, processing all transactions on-chain. The platform has surpassed $2 trillion in cumulative volume since launching in 2023.

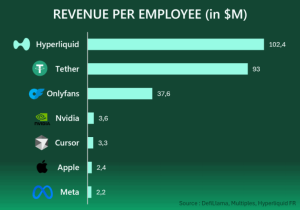

Hyperliquid’s revenue efficiency stands out in the technology sector. The platform generates more revenue per employee than Tether’s $93 million, significantly exceeding OnlyFans’s $37.6 million ratio. This performance surpasses established technology companies, including Apple, Nvidia, and Meta. Annual revenue projections reach $1.17 billion based on current growth trends.

Source: X

Market Position Strengthens Amid Institutional Interest

The platform’s Hyperliquidity Cluster achieved $3.4 billion in trading volume within 24 hours, with Bitcoin contributing $1.5 billion. This performance establishes Hyperliquid as the second-largest platform globally for Bitcoin spot trading.

BitMEX CEO Arthur Hayes projects substantial upside potential for HYPE, forecasting a 126x increase. Hayes predicts stablecoin supply will reach $10 trillion by 2028, with Hyperliquid potentially capturing over 25% of associated trading volume. His analysis suggests protocol revenues could surge from $1.2 billion to $258 billion within three years.

Institutional recognition arrived through 21Shares, which launched the first regulated Hyperliquid exchange-traded product on the SIX Swiss Exchange. The structured product provides regulated access to a protocol that controls 80% of decentralized perpetuals trading.

HYPE trades at approximately $44, representing a 1% weekly decline from its recent peak. Traders view Hyperliquid as one of the most compelling protocols in decentralized finance, though concerns remain about upcoming token unlocks.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.