- Strategy bought 4,048 Bitcoin for $444 million and now holds over 636,000 BTC worth billions.

- The company sold MSTR shares to fund the purchase, but its stock dropped 15% alongside Bitcoin’s decline from recent highs.

- When plaintiffs dismissed their claims, Strategy resolved a class action lawsuit about its Bitcoin accounting practices.

Strategy has executed another significant Bitcoin purchase, adding 4,048 BTC to its corporate treasury for $449.3 million. The business intelligence company paid an average price of $110,981 per Bitcoin, marking its fifth consecutive weekly acquisition.

The purchase brings Strategy’s total Bitcoin holdings to 636,505 BTC, acquired for a cumulative $46.95 billion at an average price of $73,765 per Bitcoin. Despite recent market volatility, the company achieved a Bitcoin yield of 25.7% year-to-date.

Share Sales Fund Latest Bitcoin Acquisition

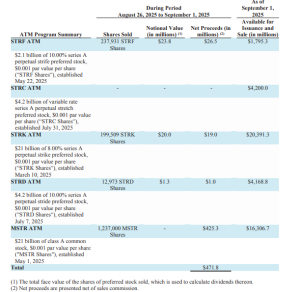

Strategy primarily financed this acquisition through equity sales, raising $425.3 million from selling 1.23 million MSTR shares. The company generated additional funds through subsidiary share sales, collecting $26.5 million from STRF shares, $19 million from STRK shares, and $1 million from additional STRF transactions.

Source: Strategy’s SEC Filing

Co-founder Michael Saylor had hinted at the purchase on August 31 through social media, stating Bitcoin remained “on sale” and suggesting the company would capitalize on market dips. This strategic approach has positioned Strategy as the largest publicly traded Bitcoin treasury company, with holdings representing over 3% of Bitcoin’s total supply.

The acquisition strategy marks a departure from previous commitments. Strategy had pledged not to issue MSTR shares for Bitcoin purchases when the premium to net asset value fell below 4.0x, but recent purchases have relied heavily on share dilution.

Stock Performance Reflects Bitcoin Correlation

MSTR stock has declined over 15% in the past month, trading around $334 at week’s close before recovering approximately 2% to $340 in recent sessions. The stock’s performance mirrors Bitcoin’s retreat from its all-time high of $124,000, reached two weeks prior.

Bitcoin trades more than 12% below its peak, demonstrating the continued correlation between Strategy’s stock price and cryptocurrency market movements. This relationship has become a defining characteristic of MSTR’s market behavior since the company adopted its Bitcoin treasury strategy.

Strategy received positive news regarding pending litigation. The plaintiffs voluntarily dismissed a class action lawsuit alleging accounting errors in the company’s reporting of Bitcoin holdings. The dismissal was filed with prejudice, preventing future refiling of identical claims.

This resolution eliminates a potential regulatory overhang that had shadowed the company’s Bitcoin accumulation strategy. The dismissal supports Strategy’s accounting practices and validates its approach to cryptocurrency treasury management.

Strategy’s continued Bitcoin purchases during market downturns demonstrate an unwavering commitment to its cryptocurrency strategy. The company’s substantial holdings have established it as a proxy for Bitcoin exposure in traditional equity markets, attracting investors seeking cryptocurrency exposure through conventional stock ownership.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.