- Strategy bought 1,955 Bitcoin for $217.4 million and now holds over 638,000 Bitcoin worth $41.17 billion.

- The company was rejected from the S&P 500 index as Robinhood, AppLovin, and Emcor were chosen instead.

- MSTR stock dropped 2% in premarket trading despite Bitcoin climbing above $112,000.

Strategy has maintained its aggressive Bitcoin acquisition strategy with another substantial purchase announcement. The crypto community was left disappointed as Strategy (Nasdaq: MSTR) couldn’t join the S&P 500 index after the rebalance on September 5.

The company acquired 1,955 BTC for $217.4 million at an average price of $111,196 per Bitcoin. This latest purchase brings the company’s total holdings to 638,460 BTC, valued at approximately $41.17 billion, with an average acquisition price of $73,880 per Bitcoin.

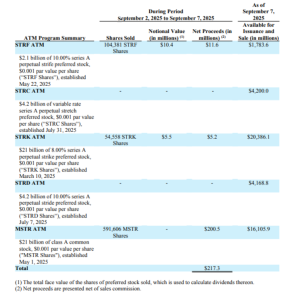

Source: Strategy’s SEC Filing

The purchase demonstrates the company’s unwavering commitment to Bitcoin despite recent setbacks. Robinhood Markets (Nasdaq: HOOD), the electronic trading exchange offering stocks and crypto assets, joined the club.

The S&P 500 Committee selected Robinhood, AppLovin, and Emcor Group instead of Strategy for inclusion in the prestigious index. The rejection occurred despite Strategy meeting all technical criteria for potential inclusion.

Stock Performance Under Pressure

The rejection hit Strategy stock hard. Shares fell almost 3% in after-hours trading, slipping below $330 and raising fears of a drop toward $300. MSTR stock trades at approximately $327 in premarket sessions, representing a decline from the previous week’s close of $335. The stock has experienced volatility over the past month, declining more than 10% despite Bitcoin’s positive momentum.

The company achieved a BTC yield of 25.8% year-to-date, highlighting the performance of its Bitcoin strategy. However, this success has not translated into immediate stock gains. The disconnect between Bitcoin’s price recovery above $112,000 and MSTR’s stock performance reflects investor uncertainty following the S&P 500 exclusion.

Funding Strategy and Market Position

Strategy financed this latest acquisition through share sales across multiple securities. The company raised $200.5 million from selling 591,606 MSTR shares, supplemented by $11.6 million and $5.2 million from STRF and STRK share sales, respectively. This funding approach continues the company’s established pattern of using equity sales to finance Bitcoin purchases.

The acquisition represents Strategy’s sixth consecutive weekly Bitcoin purchase, demonstrating systematic execution of its digital asset strategy. Analysts warn that missing the S&P 500 means missing a surge of ETF and index-fund buying. The company now controls over 3% of Bitcoin’s total circulating supply, cementing its position globally as the largest corporate Bitcoin holder.

Michael Saylor had hinted at the purchase through social media, sharing an image of the company’s Bitcoin portfolio tracker with the caption “Needs More Orange.” This communication style has become characteristic of the executive chairman’s approach to announcing acquisitions.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.