- The crypto market faces selling pressure ahead of Fed rate cuts this week, and liquidations hit $240 million with XRP, SOL, and DOGE leading declines.

- Analysts warn Bitcoin could drop 5-8% while altcoins may fall 15-20% due to triple witching effects and market uncertainty.

- Bitcoin dominance may recover to 60% in the short term, but the true altcoin season likely won’t start until late 2025 or early 2026.

The crypto market has entered a correction phase following last week’s gains, with major altcoins experiencing significant selling pressure. Bitcoin price hovers near $115,500 as traders position ahead of the anticipated Federal Reserve interest rate cuts this week.

Market liquidations have surged to $240 million across all cryptocurrencies, with long positions accounting for $176 million. XRP, Solana (SOL), and Dogecoin (DOGE) led the altcoin decline as investors took profits before the Federal Reserve’s monetary policy announcement.

Triple Witching Event Threatens Short-Term Stability

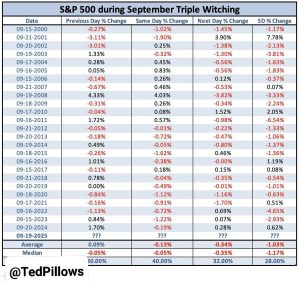

Crypto analyst Ted Pillows has warned that September’s triple witching expiration could trigger additional weakness in traditional markets. The quarterly event occurs when stock options, index options, and futures contracts expire simultaneously, creating increased volatility.

Source: Ted Pillows

Historical data shows the S&P 500 has averaged negative 1.17% returns in the week following triple witching events since 2000. Market analysts predict Bitcoin could decline 5% to 8% if this pattern continues, while altcoins may face steeper drops of 15% to 20%.

The sell-the-news momentum is taking hold as the market anticipates the Federal Reserve’s decision. Bitcoin faces resistance at current levels, with technical indicators suggesting potential topping signals in the near term.

Despite the current correction, the altcoin season index reached 84 following last week’s rally, indicating strong underlying momentum. Goldman Sachs expects three additional rate cuts before year-end, which could boost investor appetite for risk assets, including cryptocurrencies.

Bitcoin Dominance Shows Signs of Recovery

Technical analysis reveals Bitcoin dominance (BTC.D) may be finding support at key levels after recent declines. The metric could sweep toward 57.5% before advancing to 60%, strengthening Bitcoin against alternative cryptocurrencies.

Source: iWantCoinNews

While altcoins experience selling pressure, Bitcoin demonstrates relative strength by maintaining a position above $116,000. The divergence suggests institutional preference for the leading cryptocurrency during uncertain market conditions.

Market experts anticipate the true altcoin season may not materialize until late Q4 2025 or Q1 2026. Current macro developments and Federal Reserve policies will influence market structure through 2025.

The cryptocurrency market continues to react to traditional financial market events, highlighting the increasing correlation between digital assets and conventional investments. Traders remain focused on Federal Reserve communications and their potential impact on risk asset valuations.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.