- XRP’s lawsuit with the SEC officially ended after Ripple paid $125 million, but the token still trades below $3.

- Crypto lawyer Bill Morgan says regulatory uncertainty can no longer excuse XRP’s weak price performance.

- The XRP ecosystem continues expanding with new partnerships and stablecoin projects, yet market momentum remains disappointing.

A prominent crypto lawyer has declared that XRP’s price stagnation can no longer be attributed to regulatory uncertainty following the conclusion of the Ripple lawsuit. Bill Morgan stated that the XRP lawsuit has “run its course” as justification for the token’s weak price performance and limited adoption.

Yes the lawsuit excuse has run its course for any further lack of XRP adoption or flat price action. https://t.co/Gl2U8Z7Ui9

— bill morgan (@Belisarius2020) September 22, 2025

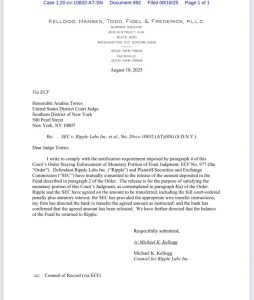

The comments emerged after CEO Jake Claver confirmed that Ripple paid its $125 million penalty to the U.S. Treasury last month. This payment ended the multi-year legal dispute between Ripple and the SEC. The conclusion stems from Ripple’s May 2025 settlement agreement with the regulatory body.

Source: X

Under the settlement terms, Ripple agreed to pay the fine and accept restrictions on specific institutional sales. The agreement preserved critical rulings distinguishing programmatic retail sales and institutional transactions. All appeals were dismissed in early August, bringing the five-year dispute to its close.

Despite achieving long-awaited legal closure, XRP has failed to generate significant price increases. The token remains trading below $3 and cannot capitalize on favorable developments, including launching the first U.S. spot XRP ETF.

Market Momentum Fails to Materialize

XRP’s performance has disappointed investors who anticipated substantial gains once regulatory uncertainty was removed. The token experienced momentum during a late 2024 rally and a brief surge earlier this year. However, this momentum has since waned considerably.

Community members express frustration that the expected price increase has not materialized despite the removal of regulatory barriers. The token’s inability to sustain upward movement following positive catalysts raises questions about underlying market dynamics.

Trading patterns suggest that legal resolution alone has insufficiently driven sustained price appreciation. Traders require additional factors beyond regulatory clarity to justify higher valuations.

Ecosystem Development Shows Promise

The XRP ecosystem has continued expanding since the lawsuit’s conclusion, potentially supporting long-term value creation. Flare Network recently announced plans for an XRP-backed stablecoin through its Liquity V2 platform. This development aims to enhance DeFi use cases and increase on-chain liquidity.

Japanese gaming and blockchain company Gumi established an XRP treasury worth 2.5 billion yen, approximately $17 million. This move aligns with SBI Holdings’ broader blockchain finance strategy and demonstrates growing corporate interest in XRP as a treasury asset.

Ripple has outlined ambitious expansion plans for its operations. The company confirmed deploying RLUSD, its U.S. dollar-backed stablecoin, across African markets. Partnerships with fintech companies, including Chipper Cash, VALR, and Yellow Card, will facilitate this expansion. The initiative will initially inject $700 million into cross-border payment channels.

Industry experts emphasize that XRP’s future performance now depends on adoption rates and innovation rather than regulatory status. ETF products are expected to launch as the SEC implements more crypto-friendly policies. Stablecoin projects and Ripple’s continued partnerships present ecosystem expansion and value growth opportunities.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.