- BlackRock bought $79 million worth of Bitcoin through its IBIT ETF, and it continues to accumulate despite market volatility.

- The asset manager filed for a new Premium Bitcoin ETF that generates income through covered call strategies.

- BlackRock prefers Bitcoin over Ethereum and sold ETH positions to buy more BTC.

BlackRock continues its aggressive Bitcoin accumulation strategy despite recent market turbulence. The world’s largest asset manager purchased 703.7 BTC worth approximately $79 million through its iShares Bitcoin Trust (IBIT) ETF.

The acquisition demonstrates institutional confidence in Bitcoin’s long-term prospects. Market data from SoSoValue confirms the purchase occurred during heightened uncertainty in cryptocurrency derivatives markets.

Source: SoSoValue

Bitcoin options worth $17 billion are scheduled to expire on Deribit, representing 152,000 BTC contracts. The put-to-call ratio of 0.75 indicates mild bearish sentiment among traders. Bitcoin maintains its trading position above $111,000 despite these market pressures.

Strategic Bitcoin Accumulation Through Multiple Channels

BlackRock executed the recent purchase through several transfers of approximately 300 BTC each. The transactions were processed via Coinbase Prime, the institutional trading platform.

Arkham Intelligence reported that BlackRock added over $125 million in Bitcoin through separate transactions the previous day. The asset manager clearly prefers Bitcoin over Ethereum in its cryptocurrency strategy.

BLACKROCK JUST BOUGHT OVER $125M OF BITCOIN

INSTITUTIONS ARE BUYING THE DIP ON $BTC pic.twitter.com/Srp8nQVG9R

— Arkham (@arkham) September 25, 2025

Recent trading activity reveals that BlackRock sold its Ethereum positions to increase Bitcoin holdings. This strategic shift generated $366.2 million in net inflows for Bitcoin while the iShares Ethereum Trust experienced $17.39 million in outflows.

The sustained accumulation pattern suggests BlackRock views current market conditions as favorable for building Bitcoin positions. Institutional inflows offset short-term market pessimism from retail traders.

Premium Bitcoin ETF Filing Targets Income-Focused Investors

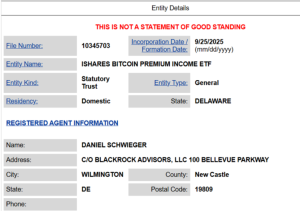

BlackRock filed for the iShares Bitcoin Premium ETF, designed to generate income through covered call strategies. The new product differs from IBIT by providing yield opportunities alongside price exposure.

Source: X

Bloomberg analyst Eric Balchunas characterized the filing as a “sequel” to IBIT. The development reflects BlackRock’s strategy to expand its cryptocurrency product suite rather than diversifying into alternative cryptocurrencies.

BlackRock registered the name iShares Bitcoin Premium ETF, filing coming soon. This is a covered call bitcoin strategy in order to give btc some yield. This will be a '33 Act spot product, sequel to the $87b $IBIT. pic.twitter.com/IR7hJ59m6q

— Eric Balchunas (@EricBalchunas) September 25, 2025

The Premium ETF aims to reduce volatility while maintaining Bitcoin exposure for income-focused investors. This approach caters to institutional clients seeking steady returns from cryptocurrency investments.

IBIT’s remarkable success supports the expansion strategy. The ETF reached $80 billion in assets under management within 374 days, setting a new industry record. Vanguard’s S&P 500 ETF previously held the record, taking nearly five years to achieve the same milestone.

BlackRock plans additional blockchain initiatives, including tokenizing traditional ETFs on-chain. Using blockchain technology, the company intends to represent conventional assets like equities in tokenized formats.

However, regulatory challenges persist for some products. The SEC delayed BlackRock’s Ethereum ETF staking request, extending the review period until October 30. This delay creates uncertainty around the approval timeline for enhanced Ethereum products.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.