- Strategy purchased 196 Bitcoin for $22.1 million and now holds 640,031 BTC worth approximately $47.35 billion at its average cost basis.

- The company raised $128 million through stock sales, but only used $22 million for this Bitcoin purchase.

- MSTR stock has dropped from $455 to around $314 and now shows only 3% gains for the year.

Strategy, formerly known as MicroStrategy, has purchased another 196 Bitcoin for $22.1 million, continuing its aggressive accumulation strategy despite ongoing market turbulence. The acquisition brings the company’s total holdings to 640,031 BTC, valued at approximately $47.35 billion based on its average purchase price of $73,983 per coin.

The latest purchase represents the company’s ninth consecutive weekly Bitcoin acquisition. Co-founder Michael Saylor signaled the move on social media with his characteristic phrase “Always ₿e Stacking,” reinforcing the firm’s commitment to expanding its cryptocurrency portfolio regardless of market conditions.

Always ₿e Stacking pic.twitter.com/XMT5rA0DYL

— Michael Saylor (@saylor) September 28, 2025

Funding Through Stock Sales

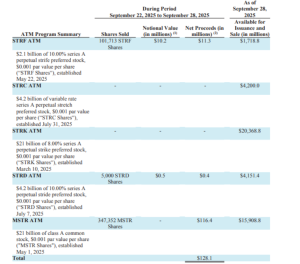

The strategy raised funds for the Bitcoin purchase through multiple stock offerings. The company generated $116.4 million from MSTR share sales, $11.3 million from STRF shares, and $400,000 from STRD shares. Only $22 million of these proceeds went toward the Bitcoin acquisition, leaving substantial capital for potential future purchases.

Source: Strategy’s SEC Filing

The company acquired 196 Bitcoin at an average price of $113,048 per coin. This purchase occurred during a period of significant volatility in both Bitcoin’s price and Strategy’s stock performance. The decision has drawn criticism from some investors who point to previous statements suggesting the company would avoid diluting common stock at current premium levels.

MSTR Stock Performance Under Pressure

Strategy’s stock has surrendered most of its year-to-date gains, now sitting at just 3% above its January levels. MSTR shares peaked at $455 earlier this year but have since retreated to approximately $314. The stock briefly dipped below $300 last week when Bitcoin fell to around $108,000.

Recent trading shows signs of recovery. MSTR closed last week at approximately $309 and gained nearly 2% in Monday’s session. The rebound coincides with Bitcoin’s movement above $112,000, demonstrating the strong correlation between the cryptocurrency’s price and Strategy’s equity performance.

The company’s persistent buying strategy has sparked debate among market observers. Critics question the wisdom of continued accumulation at elevated prices, given that the premium on MSTR shares has compressed significantly. Supporters argue the long-term Bitcoin thesis remains intact regardless of short-term price fluctuations.

The strategy’s approach represents one of the most aggressive corporate Bitcoin accumulation strategies in history. The company has transformed from a software business into what many consider a leveraged Bitcoin investment vehicle. This transformation has made MSTR stock a popular proxy for Bitcoin exposure among traditional investors who prefer equity markets over cryptocurrency exchanges.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.