- The Treasury and IRS released guidance allowing companies to exclude unrealized Bitcoin gains from tax calculations under CAMT rules.

- Strategy holds over 640,000 BTC, worth approximately $74 billion, and will no longer be subject to the 15% minimum tax on paper gains.

- The change addresses industry complaints and removes a major barrier for corporations holding large crypto portfolios.

The U.S. Treasury Department and the Internal Revenue Service have issued interim guidance that relieves major corporations from paying taxes on unrealized gains from Bitcoin. The move marks a significant policy shift that benefits companies holding substantial cryptocurrency portfolios.

The new guidance addresses concerns raised by industry leaders about the Corporate Alternative Minimum Tax (CAMT) and its application to digital assets. Companies can now exclude unrealized crypto gains and losses when calculating their adjusted financial statement income.

Changes to CAMT Regulations

The Treasury Department announced plans to withdraw portions of previously proposed CAMT regulations. The original rules would have required corporations to pay a 15% minimum tax on financial statement income that included unrealized gains from Bitcoin.

Under Financial Accounting Standards Board requirements, companies must record Bitcoin holdings at current market prices. The previous CAMT framework would have taxed these paper gains even though no actual sale occurred. This approach differed substantially from the treatment of traditional assets.

Strategy, formerly known as MicroStrategy, exemplifies the impact of these regulations. The company holds 640,031 BTC acquired for $47.35 billion. Current market values place these holdings near $74 billion. The firm reported $14 billion in unrealized gains during the second quarter alone.

Industry Response and Political Support

Multiple stakeholders pushed back against the original CAMT proposal. Strategy and Coinbase led industry efforts to exclude cryptocurrency from the calculation of unrealized gains. Both companies argued that the rule created unfair treatment compared to conventional asset classes.

Senator Cynthia Lummis championed legislative efforts to address the tax issue. The Wyoming senator introduced legislation aimed at eliminating double taxation on digital assets. She characterized the interim guidance as a victory for American innovation and the adoption of Bitcoin.

The Trump administration’s Treasury just delivered for American innovation—fixing the CAMT problem that threatened unrealized gains on Bitcoin.

This leadership clears the way for the U.S. to become the world’s #Bitcoin superpower. 🇺🇸

Thank you @USTreasury & @realDonaldTrump.

— Senator Cynthia Lummis (@SenLummis) September 30, 2025

The revised approach allows companies to disregard unrealized gains and losses on crypto holdings when determining CAMT liability. This change removes a major compliance burden that would have begun affecting eligible corporations in 2026.

The strategy filed documentation with the Securities and Exchange Commission, confirming its new position. The company stated it no longer expects to face CAMT obligations based on Bitcoin holdings. Management plans to exclude unrealized gains and losses from adjusted financial statement income calculations.

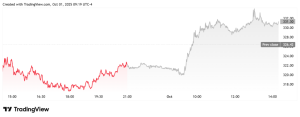

Markets responded positively to the announcement. Strategy’s stock price rose nearly 3% following the release of its guidance. Shares traded at approximately $331, up from the previous close of $322.

Source: TradingView; MSTR Daily Chart

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.