- Bhutan transferred another 419.5 BTC worth $47 million, which marks two consecutive weeks of major Bitcoin sales by the government.

- The nation still holds 9,232 BTC valued at over $1 billion, but recent moves suggest increased liquidation activity.

- Bitcoin trades near $112,550 with declining volume, and analysts expect further downward pressure on prices.

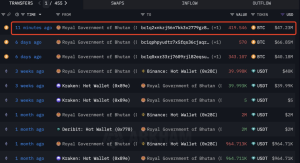

On Wednesday, the Royal Government of Bhutan executed another significant Bitcoin transfer, moving 419.5 BTC worth approximately $47.23 million. This transaction marks the sovereign nation’s second consecutive week of substantial cryptocurrency movements, raising questions about potential selling pressure in the digital asset market.

The latest transfer follows a larger movement last week when Bhutan moved 913 BTC valued at nearly $107 million to two separate wallet addresses. These transactions coincide with the Federal Reserve’s recent monetary policy adjustments and growing market volatility concerns.

Bhutan Government Moving BTC. Source: Lookonchain

Government Holdings Remain Substantial Despite Recent Transfers

Despite the recent outflows, Bhutan maintains a considerable Bitcoin position. The government’s primary wallet currently holds 9,232 BTC, representing approximately $1.04 billion at current market valuations. Blockchain analytics firm Arkham Intelligence indicates the government has occasionally sold portions of its holdings through Binance while simultaneously adding cryptocurrencies through mining operations.

The timing of these transfers aligns with broader market uncertainties. Federal Reserve Chair Jerome Powell’s recent statements have tempered expectations for aggressive interest rate cuts, citing ongoing inflation concerns. Only newly appointed Fed Governor Stephen Miran has advocated a more substantial 50 basis point reduction.

Market Response and Trading Dynamics

Bitcoin trades at $112,550, reflecting a modest 0.2% decline over the past 24 hours. The cryptocurrency reached a daily high of $113,351 and a low of $111,229 during the same period. Trading volume decreased by 13% on the last day, suggesting reduced trader interest amid current market conditions.

Multiple research firms, including 10x Research and Matrixport, have expressed bearish outlooks for Bitcoin’s near-term performance. Analysts identify the $109,899 level as a critical support threshold, particularly given negative sentiment among options traders and institutional investors.

Derivatives market data reveals mixed signals about trader positioning. Total Bitcoin futures open interest increased marginally by 0.06% to $81.69 billion over the past 24 hours. However, CME Bitcoin’s future open interest declined 1.85%, while Binance saw a 0.22% increase, indicating divergent trading strategies across major platforms.

Government selling pressure, uncertainty of monetary policy, and technical resistance have created a cautious trading environment. Traders closely monitor institutional flows and Federal Reserve communications for additional directional signals.

Bhutan’s Bitcoin strategy reflects broader sovereign wealth management considerations as governments navigate cryptocurrency integration amid evolving regulatory landscapes and market dynamics.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.