- Bitcoin retreated after strong jobs data dimmed Fed rate cut prospects.

- Key support at $108,000 could enable rallies toward $112,000 targets.

Strong US labor market data triggered a sharp pullback in Bitcoin prices Thursday, as the leading cryptocurrency retreated from session highs near $110,300. The market reaction underscored growing concerns about the Federal Reserve’s policy direction amid persistent economic strength.

Labor Market Strength Challenges Rate Cut Narrative

June employment figures substantially exceeded analyst projections, with nonfarm payrolls demonstrating continued hiring momentum. The unemployment rate also surprised to the upside, reinforcing signals of labor market resilience. Additionally, May’s employment count received an upward adjustment from 139,000 to 144,000 positions.

Traders characterized the employment metrics as exceptionally strong, suggesting Federal Reserve officials now possess additional rationale for maintaining restrictive monetary policy. The robust data effectively undermines arguments for near-term rate reductions that had previously supported cryptocurrency valuations.

Blacknox analysts indicated the unemployment decline essentially eliminates prospects for July monetary easing. Current Fed Funds Futures pricing reflects only two rate cuts through December 2025, according to Bitwise research chief Andre Dragosch for European markets.

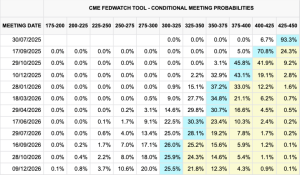

These findings starkly contrasted with Tuesday’s private employment report, which had bolstered expectations for accommodative policy shifts. CME Group’s FedWatch Tool data confirms minimal market probability for policy adjustments before September’s Federal Open Market Committee meeting.

Traders Maintain Cautious Optimism Despite Setback

Despite initial selling pressure, some market participants view the employment strength positively for longer-term prospects. Material Indicators co-founder Keith Alan suggested the knee-jerk reaction represents short-term thinking rather than fundamental weakness.

Lower unemployment correlates with economic expansion, potentially benefiting asset markets over extended timeframes. This perspective contrasts with immediate concerns about delayed monetary accommodation.

Order book analysis from CoinGlass indicates that the market infrastructure remained stable throughout the volatility. Liquidity levels above and below current prices suggest institutional participation continues supporting the market structure.

Technical analysts emphasize the importance of Bitcoin maintaining support above $108,000 for continued bullish momentum. This level has emerged as a crucial threshold determining potential upside scenarios.

Master of Crypto’s analysis suggests a successful defense of $108,000 in support could enable moves toward $112,000 and potentially $120,000. The assessment relies on maintaining the current market structure and liquidity conditions.

Cryptocurrency markets continue demonstrating sensitivity to monetary policy indicators, with employment data as a key catalyst for price movements. Future Federal Reserve communications will likely provide additional direction for digital asset valuations.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.