- Bitcoin trades near $106,470 and shows stability despite regulatory uncertainty.

- The Senate passed major stablecoin legislation with 68-30 votes.

- Trump established a Strategic Bitcoin Reserve through executive order, and the U.S. owns approximately 200,000 bitcoin.

Bitcoin maintains its position above the $106,000 mark as the cryptocurrency market responds to significant legislative developments in Washington. Current market data shows Bitcoin is trading at $107,629, demonstrating relative stability despite ongoing political uncertainty surrounding crypto regulation.

The crypto continues to face volatility as traders monitor Congressional activity related to cryptocurrency legislation. Traders remain focused on potential regulatory changes impacting the broader crypto ecosystem.

Senate Advances Major Crypto Legislation

The U.S. Senate recently passed a bill to create a regulatory framework for U.S.-dollar-pegged cryptocurrency tokens known as stablecoins, marking a significant milestone for the digital asset industry. The legislation passed by a 68-30 vote represents the first major crypto-related bill to advance through Congress.

This regulatory framework addresses long-standing concerns about stablecoin oversight and provides clearer guidelines for cryptocurrency operations. The bill now moves to the House of Representatives for potential revisions before final passage.

Legislation progress has come as the crypto industry has significantly increased its political influence. During the 2024 campaign cycle, the crypto industry ranked among the top political spenders in the country, demonstrating its growing presence in Washington policymaking.

Strategic Bitcoin Reserve Established

President Trump has taken concrete steps to establish cryptocurrency as a strategic national asset. An Executive Order was signed to establish a Strategic Bitcoin Reserve and Digital Asset Stockpile, positioning the United States as a leader in digital asset accumulation.

Government estimates suggest the U.S. owns approximately 200,000 bitcoin, though questions remain about the methodology behind these calculations. The strategic reserve initiative aims to position America as a dominant force in the global cryptocurrency landscape.

This development aligns with Trump’s broader crypto agenda. “I promised to make America the Bitcoin superpower of the world and the crypto capital of the planet,” Trump stated during recent crypto-focused events.

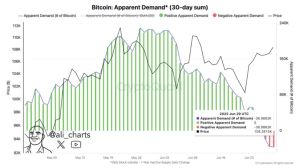

Bitcoin’s demand zone between $100,000 and $103,000 remains strong, with over $61.41 billion in BTC bought within this range, providing support during market downturns. This substantial buying interest suggests institutional and retail confidence in Bitcoin’s long-term prospects.

Technical indicators present a mixed outlook for the cryptocurrency. Bitcoin faces downward pressure with a descending wedge formation, but July’s historical positive trend and strong support could provide upward momentum.

Analysts remain optimistic about Bitcoin’s trajectory. Price predictions suggest Bitcoin could increase by 10.76% next month and reach $118,009 by July 31, 2025. Some forecasts are even more bullish, expecting significant gains throughout 2025.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.