- Bitcoin jumped 3.6% to $122,000 and approaches its all-time high before key US inflation data releases this week.

- Post-halving trends support August rally expectations while new Bitcoin addresses hit yearly highs at 364,126 daily creations.

- Fed rate cut odds increase to 40% for September as inflation concerns drive Bitcoin adoption as a safe-haven asset.

Bitcoin price surged 3.6% in the last 24 hours, crossing the $122,000 threshold as traders position ahead of critical US inflation data this week. The leading cryptocurrency trades within striking distance of its all-time high of $123,000, setting the stage for a potential breakout.

The recent rally follows a period of consolidation below $115,000, with bulls regaining momentum as market participants await Consumer Price Index and Producer Price Index releases. Technical indicators point to renewed strength, with the Golden Cross pattern emerging again on Bitcoin charts.

Post-Halving Rally Gains Momentum in August

Market analysts expect continued upward pressure throughout August, citing historical post-halving patterns that typically favor price appreciation during this period. Crypto analyst Benjamin Cowen highlighted the recurring trend of Bitcoin experiencing gains in July and August following halving events.

According to Cowen’s analysis, the pattern suggests potential pullbacks in September before reaching new cycle peaks in Q4. The post-halving narrative continues to drive institutional and retail interest as supply dynamics tighten.

Source: Benjamin Cowen

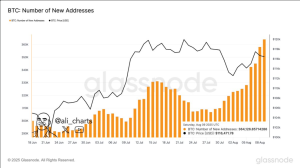

On-chain metrics support the bullish outlook. According to crypto analyst Ali Martinez, creating a new Bitcoin address reached 364,126 daily, marking the highest level in a year. This surge in network activity indicates growing adoption and user engagement.

Source: Ali Martinez

Inflation Concerns Drive Safe Haven Demand

Economic forecasts predict the July CPI will increase by 0.3%, signaling persistent inflationary pressures. Trump’s tariff policies are beginning to impact consumer prices across household goods and recreational products, creating uncertainty in traditional markets.

The Federal Reserve rate cut expectations have intensified following recent jobs data revisions. Polymarket data shows a 40% probability for two rate cuts totaling 50 basis points, while expectations for three cuts (75 basis points) jumped from 8% to 23% over the past week.

Bitcoin’s emergence as a hedge against inflation reflects growing institutional recognition of its store-of-value properties. Traditional asset managers increasingly view cryptocurrency as portfolio diversification amid monetary policy uncertainty.

Source: Polymarket

The combination of technical breakout signals, favorable seasonal trends, and macroeconomic headwinds positions Bitcoin for potential acceleration toward analyst targets of $130,000 and beyond. Traders remain focused on this week’s inflation data as the catalyst for the next major price movement.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.