- Strategy CEO Michael Saylor predicts Bitcoin will become ten times larger than gold’s market cap due to its digital advantages and growing institutional adoption.

- Over 190 public companies now hold Bitcoin in their treasuries, and Strategy leads with nearly 640,000 coins worth billions of dollars.

- Deutsche Bank expects central banks to hold Bitcoin and gold by 2030 as complementary reserve assets with different strengths.

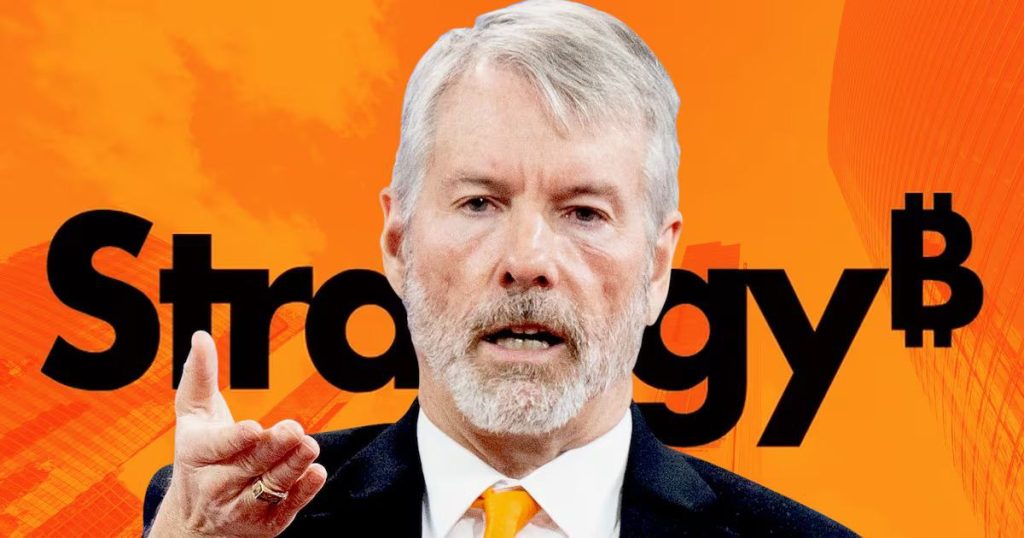

Strategy CEO Michael Saylor believes Bitcoin will achieve a market capitalization ten times larger than gold’s current valuation. During a CNBC interview, the executive made these remarks, positioning the cryptocurrency as the superior store of value for modern institutions.

Today with @MorganLBrennan, I discussed the differences between Bitcoin, Gold, and other crypto networks — and the rise of Digital Treasury Companies, Digital Credit, and Digital Finance. pic.twitter.com/sdbWWEIq0E

— Michael Saylor (@saylor) September 23, 2025

Saylor characterized Bitcoin as the “next frontier” for national reserves and corporate treasury management. He dismissed traditional assets, stating “Bitcoin is money, everything else is credit” – reimagining the classic phrase typically applied to gold.

The Strategy chief highlighted Bitcoin’s technological advantages over physical gold. The cryptocurrency’s programmable nature, borderless transfers, and immunity to import tariffs make it more practical for global commerce. “You can’t teleport gold,” Saylor noted, emphasizing the logistical constraints that limit the precious metal’s utility.

Strategic Reserve Proposals Gain Momentum

The executive expressed strong support for proposed U.S. strategic Bitcoin reserve legislation. Such reserves would strengthen government balance sheets beyond what traditional cash holdings or stock buybacks can achieve, according to Saylor.

This perspective aligns with growing institutional recognition of Bitcoin’s role in modern finance. Companies increasingly issue financial instruments backed by Bitcoin reserves, mirroring historical practices with gold-backed securities.

Saylor drew parallels between past and future monetary systems. “The world ran on gold-backed credit for 300 years,” he explained. “The world will run on digital gold-backed credit for the next 300.”

Corporate Adoption Accelerates Accumulation

Corporate Bitcoin adoption continues to expand rapidly across global markets. Strategy recently added 850 BTC worth $99.7 million to its treasury, bringing total holdings to nearly 640,000 coins. The company maintains its status as the largest corporate Bitcoin holder.

Other significant acquisitions include Japan’s Metaplanet, which expanded reserves by $632 million to reach nearly $3 billion in total holdings. Brazil’s OranjeBTC purchased 3,650 tokens valued at $385 million ahead of its public listing, establishing itself as Latin America’s largest corporate Bitcoin treasury.

Over 190 publicly traded companies now hold Bitcoin on their balance sheets. Combined institutional holdings exceed 1.5 million BTC, creating sustained upward pressure on supply dynamics. Exchange-traded funds from major asset managers like BlackRock continue accumulating coins for institutional clients.

Deutsche Bank analysts project that central banks will hold Bitcoin and gold in their reserves by 2030. The report cited complementary qualities, including scarcity, liquidity, and established trust among institutional investors.

Financial expert Robert Kiyosaki echoes this dual-asset approach, recommending investors hold Bitcoin alongside precious metals as protection against economic instability. This strategy reflects growing recognition of Bitcoin’s maturation from speculative asset to institutional reserve currency.

The convergence of corporate adoption, regulatory clarity, and technological advantages positions Bitcoin for significant growth relative to traditional store-of-value assets like gold.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.