- Nasdaq filed to list BlackRock’s Bitcoin Premium Income ETF with the SEC. The fund generates yield through the use of covered call options on Bitcoin.

- The ETF holds spot Bitcoin and IBIT shares while writing call options. It targets investors seeking regular income with lower volatility.

- The SEC confirmed eligibility and opened the public comment period. The fund prioritizes income generation over price tracking.

Nasdaq has submitted a filing to list BlackRock’s iShares Bitcoin Premium Income ETF with the U.S. Securities and Exchange Commission. The proposal, dated September 30, seeks approval to trade the fund under commodity-based trust rules. This marks BlackRock’s latest expansion in cryptocurrency investment products, following the success of its spot Bitcoin ETF.

The SEC has confirmed receipt of the submission and stated that the product meets the eligibility criteria under the General Listing Standards. The commission has opened a public comment period for the proposed rule change. BlackRock registered the fund in Delaware last week, setting the stage for a potential launch pending regulatory approval.

Covered Call Strategy for Income Generation

The new ETF employs a different approach compared to BlackRock’s existing iShares Bitcoin Trust (IBIT). While IBIT tracks Bitcoin’s spot price directly, the Premium Income ETF uses covered call options to generate yield. The fund will write call options on IBIT shares or indices tracking spot Bitcoin exchange-traded products.

According to the filing, the trust will hold spot Bitcoin, IBIT shares, and cash as primary assets. The fund may also utilize FLEX options listed on exchanges. Bloomberg analyst Eric Balchunas characterized the product as a “sequel” to IBIT rather than a diversification into alternative cryptocurrencies. The strategy targets investors seeking regular income from Bitcoin exposure while potentially reducing portfolio volatility.

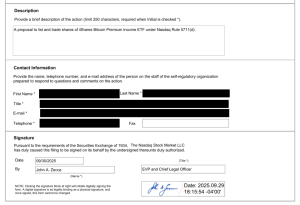

iShares Bitcoin Premium Income ETF Filing. Source: Nasdaq

Targeting Income-Focused Investors

BlackRock positions this ETF for investors prioritizing yield over pure price appreciation. The covered call strategy generates premium income by selling call options, though this approach may cap upside potential during strong Bitcoin rallies. The structure appeals to conservative investors wanting cryptocurrency exposure without full price volatility.

The filing arrives as Bitcoin trades above $114,000, with 24-hour ranges between $112,740 and $114,746. BlackRock manages the world’s largest spot Bitcoin ETF by assets, giving the firm significant influence in cryptocurrency investment products. The company has recently filed amendments for both IBIT and its Ethereum ETF (ETHA) to comply with generic listing standards, effective in Q1 2026.

Traders anticipate that the Premium Income ETF will attract institutional investors and retirees seeking yield-generating assets. The product differentiates itself from traditional spot Bitcoin ETFs by prioritizing income distribution over capital gains. If approved, the fund will trade on Nasdaq alongside other cryptocurrency investment vehicles.

The SEC’s review process typically involves multiple comment periods before reaching a final decision. BlackRock’s track record with IBIT may expedite approval, though regulatory timelines remain uncertain. The Premium Income ETF represents growing sophistication in cryptocurrency financial products as the industry matures.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.