- Traders give Cardano ETF approval a 76% chance in 2025, and Bloomberg analysts are even more bullish at 90%.

- ADA trades at $0.56 with heavy monthly losses, but ETF approval could trigger major price gains.

- The SEC will decide by Q4 2025, and technical analysis shows ADA at a critical support level that will determine its next major move.

Cardano (ADA) has captured significant attention from traders and institutional investors as speculation mounts around a potential spot ETF approval in 2025. Market sentiment has shifted notably positive in recent weeks, with prediction markets reflecting growing confidence in regulatory approval.

Blockchain prediction platform Polymarket shows traders assigning a 76% probability to Cardano ETF approval by the U.S. Securities and Exchange Commission next year. Over $374,000 has been wagered on this outcome, demonstrating substantial market interest. The platform’s pricing mechanism allows users to purchase “Yes” shares at 76 cents and “No” at 25 cents, creating a real-time gauge of market expectations.

Bloomberg Analysts Express Strong Confidence

The optimistic outlook receives support from prominent industry analysts. Bloomberg’s Eric Balchunas and James Seyffart have projected a 90% or higher approval probability for Cardano ETFs, alongside other major altcoins. Their assessment reflects improved dialogue between cryptocurrency companies and SEC officials.

This regulatory optimism stems from recent shifts in the commission’s approach to digital asset products. The crypto industry has witnessed more constructive engagement with regulators, creating a more favorable environment for ETF applications.

Despite positive ETF developments, ADA’s price performance shows mixed signals. The token trades at $0.5603, marking a 0.7% daily increase. However, monthly losses remain substantial at 25.4%, reflecting broader market volatility.

Technical Analysis Points to Critical Juncture

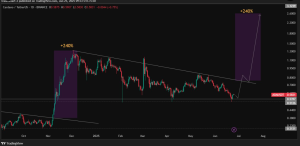

Market analysts present divergent views on Cardano’s technical outlook. One perspective highlights ADA’s approach to key trendline resistance, drawing parallels to previous chart patterns that preceded a 240% breakout. This analysis suggests potential upward movement toward $2.60 if historical patterns repeat.

Conversely, technical indicators show ADA breaking below micro support levels, potentially signaling further downside pressure. The critical $0.512 support level emerges as a key determinant for future price direction. A hold above this threshold could enable bullish recovery, while a break below may trigger additional selling pressure.

The SEC faces an expected decision deadline for Cardano ETF applications by the fourth quarter of 2025. This timeline provides a clear catalyst for potential price movement, regardless of direction.

ETF approval could mirror Bitcoin’s experience, potentially attracting billions in institutional capital. Such inflows would enhance ADA’s liquidity profile and market visibility while providing additional utility for institutional investors.

The convergence of technical analysis, regulatory developments, and market sentiment creates a compelling narrative for Cardano’s 2025 prospects. Traders continue monitoring these factors to position for potential market movements ahead of the SEC’s anticipated decision.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.