- Ethereum trades around $4,470 and shows potential to reach $5,000 based on technical analysis and institutional support.

- Major whale purchases totaling $100 million and new ETF products signal growing institutional confidence in ETH.

- Ethereum dominates the DeFi market with a 70% market share and daily DEX volumes exceeding $3.6 billion.

Ethereum maintains its position above $4,300 on September 4, 2025, as the cryptocurrency market stabilizes. The digital asset trades within a clear ascending channel, with current levels around $4,470 following recent consolidation patterns. Market analysts identify several key factors that could drive ETH toward the anticipated $5,000 milestone.

Institutional Interest Drives Market Confidence

Institutional adoption remains a primary catalyst for Ethereum’s potential upward movement. Grayscale’s recent filing for an Ethereum Covered Call Fund represents growing institutional infrastructure development. The fund structure allows investors to generate regular income through covered call strategies, where premiums from sold call options create dividend distributions.

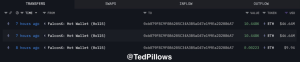

Large-scale cryptocurrency purchases continue to signal confidence among sophisticated investors. A recent $100 million whale purchase demonstrates institutional conviction in Ethereum’s trajectory. These substantial investments typically indicate that experienced market participants expect continued price appreciation.

Ethereum Whale Buys ETH

Ethereum ETF inflows have exceeded $1 billion, reflecting sustained institutional demand. The growing interest in ETFs provides traditional investors with regulated exposure to Ethereum, potentially expanding the investor base significantly.

Network Dominance Supports Long-term Value

Ethereum’s market leadership in decentralized finance strengthens its fundamental value proposition. The network commands over 70% market dominance in the DeFi sector, with major protocols like Aave, Uniswap, and Lido maintaining substantial market shares. In recent trading sessions, daily transaction volumes across Ethereum-based decentralized exchanges exceeded $3.6 billion.

The network’s stablecoin supply has reached a record $150 billion, indicating robust on-chain activity and user adoption. This metric reflects the platform’s utility as a foundation for digital asset infrastructure and financial applications.

Ethereum outperforms competing blockchain networks across multiple performance metrics, including Solana, Tron, and BNB Smart Chain. The network’s established developer ecosystem and protocol maturity provide competitive advantages in the rapidly evolving blockchain landscape.

Technical indicators support the bullish outlook for Ethereum’s price trajectory. Analysts project ETH could reach $5,000 levels by late September, with current consolidation patterns suggesting preparation for upward movement. The cryptocurrency has successfully retested support levels around $4,100, which previously served as resistance in December 2024.

Murrey Math Lines analysis indicates Ethereum sits at a weak, stop, and reverse point with significant room for advancement. The extreme overshoot target is $6,250, while the ultimate resistance level remains at $5,000. Current RSI readings around 53 suggest balanced momentum with potential for continued gains.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.