- Ethereum CME futures hit a record $7.85 billion, and spot ETFs brought in $5 billion over 16 days.

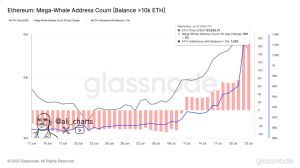

- Large investors added 170 new whale wallets with over 10,000 ETH in the past month.

- ETH trades at $3,74,4, and technical patterns suggest the price remains healthy.

Ethereum has captured unprecedented institutional attention as CME futures open interest soars to an all-time high of $7.85 billion. The milestone reflects growing professional trader engagement with the second-largest cryptocurrency by market capitalization.

CryptoQuant analyst Maartunn reported the record-breaking figures, highlighting the substantial increase in unsettled contract values. Open interest measures the total value of unresolved active derivative positions, serving as a key indicator of market participation depth.

The surge represents months of steady institutional accumulation, surpassing previous peaks during earlier Ethereum price rallies. Financial experts attribute this growth to hedge funds utilizing derivatives to manage risk exposure while positioning for potential ETH price appreciation.

Spot ETFs Drive Sustained Capital Inflows

Ethereum exchange-traded funds have maintained remarkable momentum with 16 consecutive days of net inflows totaling nearly $5 billion. SoSo Value data reveals this sustained accumulation streak ranks among the most impressive since ETH ETF products launched.

BlackRock’s Ethereum ETF continues leading inflows, now holding approximately 3 million ETH tokens. The fund’s dominance underscores institutional preference for established asset management platforms when accessing cryptocurrency exposure.

ETF analyst Nate Geraci confirmed that July 25th generated $452.72 million in net inflows, marking the fourth-largest single-day accumulation event in ETH ETF history. Ethereum ETFs have outperformed Bitcoin ETFs in daily net inflows for seven straight trading sessions.

Whale Activity and Technical Indicators Signal Strength

Ethereum whale activity has intensified significantly over recent weeks. Glassnode data shared by analyst Ali shows 170 new addresses containing over 10,000 ETH joined the network within 30 days. This expansion brings total mega-whale wallets to 1,050, indicating large-scale accumulation by institutional entities and custodians.

The current Ethereum price is $3,744, reflecting a 2.41% increase over 24 hours. Market capitalization has reached $452 billion despite daily trading volume declining 40% to $25.38 billion.

Technical analysis from TradingView data shared by Merlijn The Trader reveals that ETH remains within its long-term “master channel” pattern. This technical formation previously marked significant price reversals in 2018 and 2021 cycles.

RSI metrics have reset to healthier levels, suggesting Ethereum avoids overbought conditions that typically precede corrections. The combination of institutional inflows, whale accumulation, and favorable technical positioning creates a supportive environment for continued price stability.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.