- Ethereum ETFs recorded $510 million in positive flows over two weeks, and institutional demand continues growing steadily.

- ETH supply on exchanges hit eight-year lows at 13.5% while large holders accumulated 700,000 more ETH since May.

- Technical analysis shows ETH trading below key resistance at $2,80,0, but MVRV bands suggest room to rally toward $5,000.

Ethereum’s price action has captured significant attention following a remarkable rally that saw ETH surge over 100% from multimonth lows below $1,400 in April to peaks near $2,800. Despite trading within a tight $400 range for nearly eight weeks during the summer, multiple technical and fundamental indicators suggest the cryptocurrency could reach $5,000 in 2025.

The world’s second-largest cryptocurrency trades at $2,543, positioning itself for what analysts believe could be a substantial breakout. Market dynamics point toward growing institutional interest, reduced exchange supply, and favorable technical patterns historically preceding major price movements.

Institutional Investment Drives Market Momentum

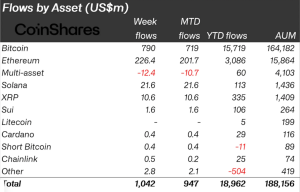

Ethereum-based investment products have demonstrated remarkable resilience with consistent capital inflows. Global Ethereum investment vehicles recorded net inflows of $226.4 million last week, according to CoinShares data. These products now average 1.6% of assets under management in weekly inflows over 11 weeks, significantly outpacing Bitcoin’s 0.8% rate.

James Butterfill, head of research at CoinShares, noted this development highlights a notable shift in investor sentiment toward Ethereum. The trend reflects growing institutional confidence in the network’s long-term prospects and utility.

US-based spot Ethereum ETFs have shown particularly strong performance. BlackRock’s iShares Ethereum Trust (ETHA) led the charge with inflows totaling $148.5 million on Thursday alone. Farside Investors’ data shows the sector recorded approximately $510 million in positive net flows over the past two weeks.

The eighth consecutive week of positive inflows into these investment products resulted in net flows exceeding 61,000 ETH. This sustained institutional demand creates a foundation for potential price appreciation, with analysts suggesting a recovery above $2,800 could trigger a rally toward new all-time highs in the second half of 2025.

Supply Shortage Signals Potential Price Explosion

Exchange supply data reveals a critical factor supporting bullish price projections. Glassnode analytics show that the ETH balance on exchanges has reached an eight-year low of 13.5%, levels not seen since July 2016. This reduction in available supply creates conditions for what traders term a “supply shock.”

The phenomenon occurs when increased demand meets decreased supply availability. Large holders, commonly known as whales, have accelerated their accumulation strategies recently. Wallets containing 100,000 or more ETH have increased their holdings to 18.8 million ETH as of Monday, up from 18.1 million ETH on May 21.

This accumulation pattern suggests institutional and high-net-worth investors view current price levels as attractive entry points. The withdrawal of significant ETH quantities from exchanges reduces immediate selling pressure and supports price stability during market volatility.

Technical Analysis Points to $5,000 Target

The Spent Output Profit Ratio (SOPR) metric indicates limited profit-taking despite most ETH holders maintaining profitable positions. Current SOPR readings of 1.01 reflect market confidence and reluctance to sell at current levels. Historical analysis shows that SOPR values above one during uptrends typically indicate room for additional price appreciation.

Market Value Realized Value (MVRV) ratio analysis provides insight into ETH’s price potential. The cryptocurrency has traded within a well-defined range of $2,400 to $2,800 since May. MVRV extreme deviation pricing bands suggest significant expansion room before unrealized profits reach extreme levels.

The upper MVRV bands indicate potential price targets between $4,000 and $5,000. Weekly chart analysis reveals a V-shaped recovery pattern forming since December 2024, with ETH currently trading below a key supply-demand zone between $2,600 and $2,800.

Bulls must push prices above this critical area to increase the probability of reaching the pattern’s neckline at $4,100. A successful breakout could target the 2021 all-time high of $4,800, representing a 92% increase from current levels.

Several market analysts support the $5,000 price target, citing Ethereum network upgrades, technical pattern forecasts, and increasing institutional demand from companies adding ETH to their treasury reserves. The convergence of these factors creates a compelling case for significant price appreciation in the coming months.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.