- The Ethereum Foundation sold $43 million worth of ETH and will use the funds for ecosystem development.

- ETH price dropped 1% after the announcement, but institutional buyers like BitMine are accumulating large amounts.

- The Foundation still holds $995 million in ETH and plans to continue funding research and grants.

The Ethereum Foundation has liquidated $43 million worth of ETH tokens to support ongoing ecosystem development initiatives. The organization will convert 10,000 ETH through centralized exchanges using smaller transactions to reduce market impact.

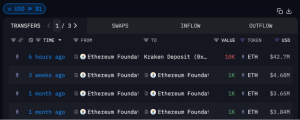

Blockchain analytics revealed a 10,000 ETH deposit into the Kraken exchange valued at $42.7 million shortly before the official announcement. The Foundation maintains substantial reserves with 231,600 ETH remaining in its treasury, worth approximately $995 million. This positions the organization as the fourth-largest public ETH holder globally.

Source: Arkham Intelligence; On-Chain ETH Transfers

The proceeds will finance research projects, grants, and philanthropic activities across the Ethereum ecosystem. The Foundation allocated $32.65 million to new projects during the first quarter of 2025 alone. Notable contributions include a $1.25 million donation to support the legal defense fund for Tornado Cash developer Alexey Pertsev.

Market Response Shows Cautious Sentiment

ETH price declined 1% over 24 hours following the sale announcement, underperforming the broader cryptocurrency market’s 0.6% drop. Market analysts attribute the weakness to multiple factors, including reduced inflows into spot ETH exchange-traded funds.

Spot ETH ETF inflows have decreased significantly after an initial surge of $533 million. Bitcoin liquidations exceeded $47.9 million in a single trading session, creating broader risk-off sentiment that affected ETH markets.

The recent sale continues a pattern of regular ETH disposals by the Foundation. The organization sold over 4,000 ETH for nearly $19 million last month. Additional smaller sales occurred in April when 1,000 ETH was transferred to the Kraken exchange.

Critics argue the timing of these sales dampens market momentum during periods of already weakened sentiment. However, the Foundation maintains transparency regarding its treasury management strategy and reinvestment goals.

Institutional Accumulation Provides Market Balance

Large-scale institutional purchases help offset Foundation sales pressure. BitMine recently acquired 153,075 ETH worth $668 million, expanding its position as the world’s largest corporate Ethereum holder.

The purchase increased BitMine’s total holdings to nearly 1.87 million ETH, creating a portfolio valued above $8 billion. This institutional accumulation demonstrates continued confidence in Ethereum’s long-term prospects despite short-term selling pressure.

The Foundation’s transparent approach to treasury management aims to support network development rather than create market disruption. Regular sales fund critical infrastructure improvements and community initiatives essential for Ethereum’s growth.

Traders note that institutional buying activity can effectively counterbalance Foundation sales when timed appropriately. The organization’s commitment to reinvesting proceeds into network development may provide long-term value despite temporary price pressure.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.