- Ethereum whales bought $10 million worth of ETH in just hours, but the price remains at $2,427.

- The cryptocurrency faces a key resistance at $3,000, and analysts predict it could reach $10,000 based on historical patterns.

- ETF inflows and whale accumulation are increasing, yet Ethereum still struggles to break out despite the bullish signals.

The cryptocurrency market is experiencing renewed optimism as major Ethereum investors demonstrate confidence through substantial token purchases. Recent on-chain data reveals that whale investors acquired approximately $10 million worth of ETH within hours, signalling potential upward momentum for the world’s second-largest cryptocurrency.

Ethereum currently trades at $2,427 with a market capitalisation of $293.06 billion. Despite increased institutional interest and network activity, the digital asset has faced challenges breaking through key resistance levels.

Major Whale Activity Drives Market Attention

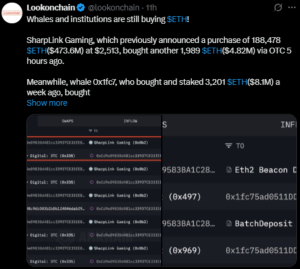

Two significant transactions highlighted the recent buying pressure on Ethereum. SharpLink Gaming purchased 1,989 ETH valued at $4.82 million as part of a larger acquisition strategy. The gaming platform announced plans to acquire 188,478 tokens worth $473.6 million.

Another whale address, identified as 0x1fc7, bought 1,888 ETH worth $4.56 million during the same period. These purchases brought the combined whale activity to nearly $10 million within hours.

Data from CryptoQuant indicates that Ethereum accumulation recently reached all-time highs. Exchange-traded fund inflows have also contributed to increased demand for ETH tokens. However, the price response has remained muted despite these positive indicators.

The crypto market has recovered from earlier concerns about Middle East tensions. Investor sentiment improved as geopolitical fears subsided, though Ethereum continues to lag behind other major cryptocurrencies regarding price appreciation.

Price Targets and Technical Analysis

Ethereum faces a critical resistance level at $3,000 that has proven difficult to overcome. The cryptocurrency experienced a 31% decline in the second quarter of 2025 and has been consolidating for over a week.

Technical analysts maintain bullish long-term outlooks for Ethereum despite current price weakness. Some experts project that the cryptocurrency could reach $10,000 based on historical cycle patterns.

Crypto analyst Ted noted that ETH typically retests lower channel levels once per market cycle. His analysis suggests this pattern preceded significant rallies in previous cycles, including a 400x increase in 2017 and a 50x surge in 2021.

According to these projections, even a modest 6x rally from current levels would push Ethereum’s price toward the $10,000 target. The analyst believes the recent retest positions ETH for potential substantial gains.

Investors await catalysts to trigger a breakout above the $3,000 resistance level. Success surpassing this threshold could validate bullish predictions and attract additional institutional capital to the Ethereum ecosystem.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.