- The Fed has a third mandate for moderate long-term rates. Officials may use this to justify yield curve control.

- Stephen Miran’s Fed confirmation renewed focus on this policy. It could weaken the dollar and boost bond purchases.

- Bitcoin may benefit as investors flee low-yield bonds. Crypto could see major capital inflows.

Stephen Miran, recently confirmed as Federal Reserve governor, has brought renewed attention to a largely forgotten provision in the Federal Reserve Act. The “third mandate” requires the central bank to maintain “moderate long-term interest rates” alongside its traditional dual mandate of price stability and maximum employment.

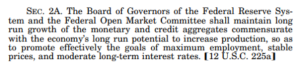

The Federal Reserve Act Congressional Review Policy. Source: US Government Publishing Office

Market analysts suggest this statutory requirement could justify yield curve control policies, potentially weakening the dollar and driving capital flows into alternative assets like Bitcoin. The provision has remained dormant for decades while policymakers focused primarily on inflation targeting and employment objectives.

Yield Curve Control on the Horizon

Bond traders are reconsidering their strategies as the third mandate gains prominence among Federal Reserve officials. Potential policy tools include large-scale bond purchases and sustained monetary expansion to suppress long-term yields.

Current market conditions present an ideal environment for implementing such measures. Bond yields across all maturities have approached yearly lows as labor market weakness builds expectations for additional rate cuts. The Federal Reserve delivered another quarter-point reduction this week, with market pricing further easing before year-end.

George Catrambone from DWS Americas outlined a scenario where the third mandate might be activated. The trigger would involve sustained elevation of long-term yields despite the Fed delivering multiple rate cuts. Such conditions would create pressure for direct intervention in bond markets.

Crypto Markets Positioned to Benefit

BitMEX co-founder Arthur Hayes expressed optimism about the third mandate’s implications for digital assets. He suggested yield curve control could propel Bitcoin toward the $1 million milestone as investors seek alternatives to traditional fixed-income investments.

Christian Pusateri from Mind Network characterized the policy as “financial repression by another name.” He warned that tighter control over money pricing reflects underlying instabilities in the balance between capital and labor.

The dollar index has already shown weakness, dropping to 96.7 this week – its lowest level in over two months. Currency markets respond to expectations that yield curve control would significantly impact dollar valuations.

Pension funds and insurance companies stand to benefit most from suppressed long-term rates. These institutions face substantial losses when bond yields rise sharply, making yield curve control an attractive policy for maintaining financial stability.

Risk assets, including cryptocurrencies, could experience increased capital inflows as investors abandon low-yielding bonds. Bitcoin advocates position the cryptocurrency as a hedge against expanded monetary policy and government financial intervention.

The timing remains uncertain for when officials might invoke the third mandate in practice. However, the confirmation of advocates like Miran to key Federal Reserve positions suggests the policy framework could gain traction in the coming months. Market participants prepare for shifts that could fundamentally alter monetary policy implementation and asset allocation strategies across global financial markets.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.