- BitMEX co-founder Arthur Hayes predicts HYPE token could surge 126x based on Hyperliquid’s growing market share.

- The decentralized exchange now processes more Bitcoin volume than Coinbase and Bybit combined.

- HYPE has gained 300% since April and trades at $45 with strong volume growth.

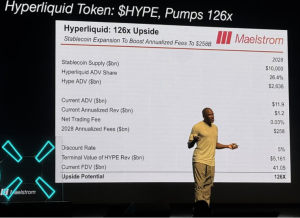

BitMEX co-founder Arthur Hayes has issued a bold prediction for the Hyperliquid token (HYPE), forecasting a potential 126x upside at the WebX Asia conference. The cryptocurrency veteran believes the decentralized exchange’s native token could benefit substantially from explosive revenue growth on the platform.

HYPE price gained 5% today despite broader market corrections affecting most cryptocurrencies. Hayes’ latest projection represents a significant increase from his $100 target for the token announced earlier this year.

Revenue Projections Drive Bullish Outlook

Hayes projects the global stablecoin market will reach $10 trillion by 2028. His analysis suggests Hyperliquid could capture 26.4% of trading volume associated with this expanded market. The decentralized exchange currently manages over $6.2 billion in assets under management.

According to Hayes’ calculations, annual revenues of $1.2 billion could surge to $258 billion by 2028. He applied a 5% discount rate to determine the terminal value of HYPE token revenues at $5.161 trillion. A fully diluted valuation of $41.05 billion creates the projected 126x upside potential for early investors.

Source: WebX Asia conference

The forecast is one of the most optimistic predictions for any DeFi protocol token. Hayes believes the expanding stablecoin ecosystem will drive this extraordinary growth trajectory for Hyperliquid.

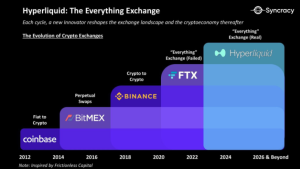

Platform Challenges Industry Leaders

Hyperliquid has become a serious competitor to established exchanges like Coinbase and Bybit. The platform recently achieved Bitcoin spot trading volumes exceeding the combined totals of these major centralized exchanges.

Ryan Watkins from Syncracy Capital noted that Hyperliquid’s Bitcoin spot market processed more 24-hour volume than Coinbase and Bybit. The exchange has established itself as a leading platform for spot trading across Bitcoin, Ethereum, and Solana.

Source: Syncracy Capital

Recent platform activity includes nine-figure Bitcoin deposits and substantial Ethereum withdrawals completed within minutes. Circle, the regulated issuer of USDC stablecoin, has moved assets through the decentralized exchange infrastructure.

The platform operates seamlessly across different market participants, positioning itself as a comprehensive trading solution. Large-scale transactions demonstrate the exchange’s capacity to handle institutional-level activity.

HYPE token has rallied 300% from April lows and trades at $45. The cryptocurrency ranks among the top 15 digital assets by market capitalization. Daily trading volume increased 78% to $278 million, indicating strong trader interest.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.