- Hyperliquid hit record $6.2 billion AUM with $395 million daily inflows and Galaxy Digital’s $100 million deposit.

- Platform now holds 70% of Arbitrum’s USDC liquidity and ranks third globally among derivatives exchanges.

- HYPE token rose 5% amid native USDC integration and surging DeFi futures trading volumes.

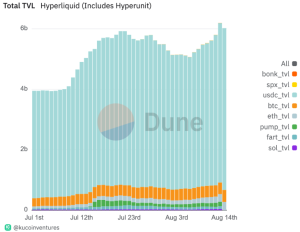

Hyperliquid has achieved a new milestone with assets under management (AUM) hitting $6.2 billion, driven by substantial institutional inflows and growing market confidence. The decentralized derivatives exchange recorded this breakthrough on August 13, marking a significant expansion in its market presence.

The surge was primarily fueled by a single-day net inflow of $395 million, consisting of $304 million in USDC deposits and $47.6 million in Ethereum. Galaxy Digital contributed the largest individual deposit in platform history, moving $100 million USDC into Hyperliquid. This institutional backing demonstrates growing confidence in the platform’s capabilities.

Source: Dune

The achievement coincides with HYPE token price appreciation of approximately 5%, reflecting positive market sentiment surrounding the platform’s growth trajectory.

USDC Integration Drives Platform Growth

Circle’s recent announcement of native USDC support through its Cross-Chain Transfer Protocol (CCTP v2) has significantly boosted Hyperliquid’s appeal. This integration enables direct USDC transfers between blockchains, streamlining the user experience without requiring wrapped tokens.

Hyperliquid now commands 70% of USDC liquidity on Arbitrum, with holdings increasing from $4 billion in early July to $5.5 billion by August. The platform’s USDC total value locked reached an all-time high of $5.23 billion following Galaxy Digital’s deposit.

USDC inflows dominated July’s growth metrics, contributing $1.2 billion in net deposits. This momentum helped Hyperliquid add $1.5 billion to its total AUM within a month, demonstrating sustained institutional interest.

Market Position Strengthens Among Derivatives Exchanges

Hyperliquid’s market share among derivatives exchanges climbed to 22.8% in August, securing third place globally. The platform’s decentralized, order-book model appeals to traders seeking greater asset control compared to centralized alternatives.

The exchange’s expansion has contributed to record-breaking DeFi perpetual futures volumes. July witnessed $465 billion in total DeFi perpetual trades, representing a 27% increase according to DefiLlama data.

Last month, open interest reached $10.6 billion, indicating heightened trader engagement and deeper market liquidity. Analysts suggest this trend may reduce circulating HYPE token supply, potentially supporting continued price momentum.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.