- Metaplanet bought 775 more Bitcoin and now holds 18,888 BTC worth $2.18 billion.

- The company’s Bitcoin reserves are 18.67 times larger than its debt obligations.

- Bitcoin dropped 7% from its $124,500 all-time high, but Metaplanet posted record quarterly profits.

Japan’s Metaplanet purchased an additional 775 Bitcoin on Monday as the cryptocurrency experienced a sharp correction from recent record levels. The acquisition brings the company’s total Bitcoin holdings to 18,888 BTC, valued at approximately $2.18 billion at current prices.

The purchase comes as Bitcoin retreats 7% from its all-time high of $124,500 reached last week. The cryptocurrency currently trades around $115,000, with analysts monitoring potential further declines toward $110,000 support levels.

Strategic Bitcoin Treasury Expansion

Metaplanet has established itself as Japan’s equivalent to Strategy through aggressive Bitcoin accumulation. The company now ranks as the seventh-largest Bitcoin holder globally, according to Bitcoin Treasuries data. The firm sits just behind Bitcoin mining company Riot Platforms in the rankings.

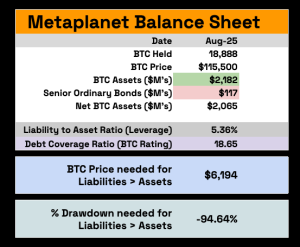

The latest purchase reinforces Metaplanet’s over-collateralized position. The company’s Bitcoin reserves now exceed its outstanding debt obligations by 18.67x. This substantial buffer means Bitcoin prices would need to fall 94.6% to approximately $6,200 before the company’s Bitcoin net asset value matches its senior bond obligations.

Source: Dylan LeClain

Metaplanet’s Bitcoin strategist, Dylan LeClair, highlighted the company’s robust financial position. The firm’s average Bitcoin purchase price is $102,653 per coin, generating a year-to-date yield of 480.2% for 2025. Outstanding ordinary bonds total just $120 million against Bitcoin holdings worth over $2 billion.

Strong Quarterly Performance Drives Investor Interest

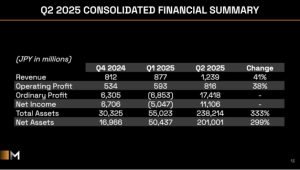

Metaplanet delivered record-breaking results in the second quarter of 2025. The company reported ordinary profit of ¥17.4 billion, reversing a ¥6.9 billion loss from the previous quarter. Net income reached ¥11.1 billion compared to a ¥5.0 billion loss in the prior year.

Revenue climbed 41% quarter-over-quarter to ¥1.239 billion. Gross profit increased 38% to ¥816 million during the same period. Total assets surged 333% to ¥238.2 billion, while net assets jumped 299% to ¥201.0 billion, creating an equity ratio of 84.2%.

CEO Simon Gerovich called the quarter “the strongest in Metaplanet’s history” following the earnings announcement. The company’s stock became the top purchase on NISA accounts last week as investors seek Bitcoin exposure through traditional equity markets.

Source: Metaplanet

However, Metaplanet shares have corrected 17% recently, trading at 850 JPY as broader cryptocurrency markets face selling pressure. Trading volume in Bitcoin increased 22% to $57 billion as the digital asset searches for stable support levels.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.