- Metaplanet stock surged 17% after Nakamoto Holdings announced a $30 million investment, and the company raised $1.4 billion for Bitcoin purchases.

- The Japanese firm currently holds 20,136 Bitcoin and plans to add 11,000 more coins with the new funding.

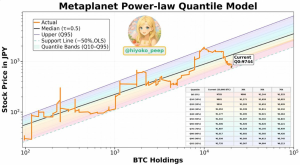

- Technical analysis shows the stock may have bottomed at oversold levels after falling 70% from June highs.

Metaplanet shares experienced a significant rally on Wednesday, climbing 17% on the Tokyo Stock Exchange. The surge marks a potential reversal for the Japanese Bitcoin treasury company after enduring a 26% decline last month.

The stock movement followed two major announcements that renewed investor confidence. Nakamoto Holdings revealed a $30 million investment commitment through its subsidiary KindlyMD. Simultaneously, Metaplanet disclosed plans to raise $1.4 billion in additional capital for Bitcoin acquisitions.

Strategic Investment Boosts Market Confidence

Bitcoin treasury firm Nakamoto Holdings announced its substantial investment in Metaplanet through NASDAQ-listed KindlyMD. The $30 million commitment represents Metaplanet’s international equity financing initiative.

Nakamoto Holdings will complete the funding on September 16. Common stock issuance and delivery are scheduled for September 17. David Bailey, Chairman and CEO of KindlyMD, praised Metaplanet’s position in Japan’s Bitcoin ecosystem.

The executive highlighted Metaplanet’s role in advancing financial innovation and promoting global Bitcoin adoption. Bailey expressed confidence that the investment would strengthen the network of companies integrating Bitcoin into institutional finance.

Metaplanet has increased its capital reserve allocation from 5% to 10%. This adjustment supports the company’s Bitcoin income-generation strategy. The firm maintains 20,136 BTC following recent purchases, with a market-to-net asset value ratio of 1.5.

The new $1.4 billion fundraise enables Metaplanet to acquire approximately 11,000 additional Bitcoin. This expansion would increase total holdings by 50%. The company plans to direct earnings from its Bitcoin strategy toward dividend payments to shareholders.

Technical Analysis Points to Recovery Potential

Market analysis suggests Metaplanet stock has reached oversold conditions. The Power-law Quantile model indicates a stock bottom at 705 JPY. Fair value estimates place the stock at 1,332 JPY, suggesting significant upside potential from current levels.

Source: Zynx | Hiyoko Peep

The stock has declined nearly 70% since reaching a high of 1,900 JPY in June. Wednesday’s rally represents the first substantial recovery attempt following this extended correction period.

Metaplanet operates as Asia’s largest Bitcoin holding public company. The firm’s aggressive accumulation strategy positions it as a key player in institutional Bitcoin adoption across the region. Recent developments demonstrate growing institutional interest in Bitcoin treasury strategies among Asian corporations.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.