- Quantum computing and AI could silently break blockchain security and compromise older Bitcoin wallets.

- Hackers are collecting encrypted data to decrypt it later when quantum hardware improves.

- The crypto industry is developing quantum-resistant solutions, but adoption is still limited and slow.

A rising concern is gripping the crypto security world: quantum computing. David Carvalho, CEO of post-quantum infrastructure firm Naoris Protocol, warns that many in the blockchain space are underestimating a threat that could undermine the cryptographic foundations of Bitcoin and Ethereum.

Carvalho, a former hacker turned cybersecurity expert, believes blockchain security is on borrowed time. “Quantum is coming for it all, like meteors came for the dinosaurs,” he said.

Quantum Harvesting and Post-Crypto Risk

Current quantum computers can’t yet break Bitcoin’s SHA-256 hash or Elliptic Curve Digital Signature Algorithm (ECDSA), but state actors and cybercriminals are preparing with a “harvest now, decrypt later” model. Encrypted blockchain data is being collected in anticipation of future decryption capabilities. Agencies like the NSA and NIST have already advised migrating to quantum-resistant standards by 2035.

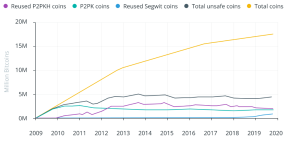

According to Carvalho, the urgency is being overlooked. Up to 25% of Bitcoin is still held in legacy address formats, which makes it more vulnerable to quantum attack. Projects such as BIP-360 propose mitigation through quantum-resistant addresses, and firms like Naoris are building new infrastructure using post-quantum cryptography. But broad adoption remains limited.

The real concern isn’t just brute-force decryption. Carvalho highlights the growing danger of AI-augmented quantum attacks. Combined, these technologies could exploit cryptographic weaknesses quietly, without immediate detection. AI systems can identify obscure wallet bugs and simulate network responses in real-time.

Such threats won’t announce themselves. “You won’t get a warning that a 10-year-old Bitcoin wallet has been cracked. You’ll see funds moved, and no one can prove how or by whom,” Carvalho noted. This scenario, termed a “silent collapse,” could destroy trust in blockchain systems before the industry reacts.

Centralized Infrastructure Remains a Risk

Despite Bitcoin’s decentralized protocol, much of its infrastructure is still centralized. Mining pools, validator networks, and cloud service providers present single points of failure. If quantum-capable adversaries breach these, the ripple effect could be severe.

“Decentralization is great on paper, but if everyone’s routing through the same few backbones or trusting a handful of third-party APIs, the game’s already lost,” Carvalho warned.

The race is on to build quantum-resilient systems. Whether through rollups, zero-knowledge STARKs, or cryptographic upgrades, the crypto industry must accelerate its defenses. The threat is no longer theoretical, and the countdown may have already begun.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.