- SHIB is forming a falling wedge pattern and could rally 24% to $0.0000148 if it breaks above $0.0000119 resistance.

- Long traders on OKX are positioning for gains with a 2.24 long-to-short ratio while open interest stays stable at $131 million.

- Exchange outflows exceeded inflows this week, and fewer people are selling their SHIB tokens at current prices.

Shiba Inu (SHIB) closed Friday’s trading session at $0.0000114, marking a modest 2.26% increase over the previous 24 hours. The meme cryptocurrency generated $86 million daily trading volume as market participants watched for signs of directional movement.

Technical analysis suggests SHIB may be positioning for a significant upward move. The token has formed a falling wedge pattern, with resistance at $0.0000119 proving difficult to overcome for nearly two weeks. This formation typically indicates weakening bearish pressure and potential bullish momentum ahead.

Technical Pattern Points to Price Recovery

The falling wedge structure presents clear targets for potential gains. Should SHIB break above the $0.0000119 resistance level, analysts project an initial target of $0.0000148. This represents approximately 24% upside from current levels, calculated based on the pattern’s height projection.

A more aggressive scenario could see SHIB reach $0.0000177, marking the upper boundary of the bullish formation. The Awesome Oscillator (AO) indicator supports this outlook, showing green signals within negative territory. This development suggests bearish sentiment is losing strength.

Market momentum could accelerate if the AO crosses above the zero line. Such a move would confirm the bullish thesis and potentially attract more buyers.

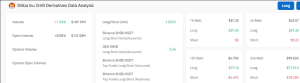

Derivatives data from OKX exchange reveals growing optimism among professional traders. The long-to-short ratio has reached 2.24, meaning long positions outnumber short positions by more than two to one. This concentration of bullish bets indicates traders expect higher prices ahead.

Open interest remains stable at $131 million, suggesting existing position holders maintain their exposure despite recent price weakness. The overall long-short ratio across all exchanges sits at neutral levels, 1.0, but the OKX data shows concentrated bullish sentiment among active traders.

Exchange Flows Indicate Supply Constraints

Spot market data from Coinglass reveals notable changes in SHIB token movement. Exchange outflows have exceeded inflows over the past seven days, indicating holders are removing tokens from trading platforms. This behaviour typically occurs when investors expect prices to rise and prefer to hold rather than sell.

Reduced exchange balances can create supply constraints that amplify price movements when demand increases. With the bullish technical setup and positive futures positioning, SHIB may prepare for a significant rally.

Market conditions appear aligned for potential upward movement. Converging technical patterns, derivatives positioning, and supply dynamics create a framework for the projected 24% advance. Traders await confirmation through a decisive break above the $0.0000119 resistance level.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.