- SOL dropped 15% to $146.26, but Solana reclaimed second place in DEX volumes with $64.1 billion over 30 days.

- The memecoin sector weakness hurt sentiment as major tokens like Giga and Popcat fell 25-42% recently.

- A potential Solana ETF approval in October could drive price recovery while the network’s technical strengths support long-term growth.

Solana’s native token, SOL, has experienced a significant 15% decline since failing to break above the $168 resistance level on June 12. The cryptocurrency trades at $146.26, reflecting broader market uncertainty and reduced network activity.

The price weakness emerged following decreased demand for memecoins and lower overall network engagement. However, recent developments suggest potential recovery momentum as Solana regains market share in key sectors.

DEX Volume Surge Signals Network Strength

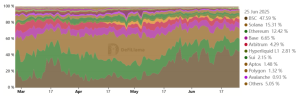

Solana has reclaimed the second position in decentralized exchange volumes, generating $64.1 billion over the past 30 days. This performance surpassed Ethereum’s $61.4 billion during the same period, according to DefiLlama data.

BNB Chain maintained its leading position with $159.6 billion in trading volume. Solana’s market share growth throughout June demonstrates the network’s resilience despite price pressures.

Key platforms driving this volume include Raydium with $19.1 billion, Pump.fun contributing $14.2 billion, and Orca generating $13.9 billion. These figures highlight the ecosystem’s diverse trading infrastructure.

Despite recent gains, overall DEX activity remains 91% below January levels. This substantial gap indicates room for further growth as market conditions improve.

The memecoin sector continues experiencing significant pressure, with major tokens posting substantial losses over 16 days. Giga dropped 42%, while Popcat declined 35%. Fartcoin and PNUT fell 31%, with Bonk and WIF losing 25%.

These declines have dampened enthusiasm about Solana’s rising DEX market share. Memecoin trading previously served as a major driver of network activity and SOL demand.

The sector’s weakness reflects broader market rotation away from speculative assets. Investors appear increasingly focused on utility-driven projects and established cryptocurrencies.

Competitive Challenges and Future Outlook

Hyperliquid’s emergence as the dominant perpetual trading blockchain presents challenges for Solana’s growth trajectory. The platform’s 30-day trading volume exceeded its five largest competitors by 84%.

This development has reduced interest in Ethereum layer-2 solutions and standalone Solana and BNB Chain applications. Successful projects may launch independent blockchains, potentially including major Solana-based applications like Pump.fun.

Derivatives markets reflect weakening conviction among traders. Perpetual futures funding rates have shown no sustained optimism for SOL over the past month. Neutral markets typically display annualized funding rates between 5% and 12% for long positions.

The most significant catalyst for SOL remains the potential approval of a Solana spot exchange-traded fund by the Securities and Exchange Commission. A decision is expected in October, providing a clear timeline for institutional adoption.

Technical strengths support Solana’s long-term prospects despite current challenges. The network’s robust base layer enables native token usage as collateral, while the absence of off-chain matching engines protects users from transaction manipulation.

Solana’s low fees and high scalability position the network competitively against emerging alternatives. While Hyperliquid represents a notable exception, other new blockchains like Berachain have struggled to maintain meaningful deposit levels.

The $180 level recovery remains possible before the October ETF decision, contingent on sustained DEX volume growth and broader market improvement.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.