- Over 25% of South Koreans aged 20-50 now own cryptocurrency, making up 14% of their total investment portfolios.

- People in their 40s lead adoption at 31% while older investors increasingly use crypto for retirement planning and wealth building.

- Most investors want stronger regulations and traditional bank involvement before they expand their crypto investments further.

Over 25% of South Koreans aged 20 to 50 now own cryptocurrency, with digital assets comprising 14% of their total investment portfolios. The Hana Institute of Finance released these findings Sunday in a comprehensive study examining virtual asset investment trends among Korea’s working-age population.

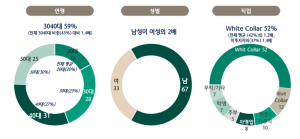

The research reveals crypto adoption spans multiple generations. Adults in their 40s lead participation rates at 31%, while those in their 30s follow at 28% and 50-year-olds at 25%. This broad demographic spread challenges assumptions about cryptocurrency being primarily a young investor phenomenon.

Investment Motivations Shift Toward Long-Term Planning

Investment motivations have evolved significantly among Korean crypto holders. Nearly 78% of respondents in their 50s use cryptocurrency to build wealth accumulation strategies. Additionally, 53% of this age group views crypto as a retirement preparation tool.

Growth potential, portfolio diversification, and structured savings plans are primary investment drivers. These motivations represent a shift from earlier speculative trading patterns toward more strategic financial planning approaches.

Regular investment habits are becoming standard practice. The proportion of investors making scheduled purchases jumped from 10% to 34%. Mid-term trading strategies increased from 26% to 47%, while short-term trading activity decreased slightly.

Market Expansion Plans and Regulatory Expectations

Future investment enthusiasm remains strong across demographics. Approximately 70% of survey participants expressed interest in expanding their cryptocurrency holdings. However, institutional involvement and regulatory clarity remain key factors influencing investment confidence.

Nearly 42% of respondents indicated they would increase investments if traditional financial institutions played larger roles in crypto markets. Meanwhile, 35% cited stronger legal protections as essential for boosting investment confidence.

Bitcoin maintains dominance as the preferred cryptocurrency choice. Six out of ten investors include Bitcoin in their portfolios. As experience levels increase, many investors diversify into alternative cryptocurrencies and stablecoins. Non-fungible and security tokens remain niche investments, with 90% of participants focusing exclusively on traditional cryptocurrencies.

A significant operational challenge involves banking restrictions. Current regulations prevent linking multiple bank accounts with cryptocurrency exchanges. Seven out of ten investors would prefer using their primary banks if these restrictions were relaxed.

Market volatility concerns persist among 56% of investors. Exchange security and fraud risks worry those hesitant about further investments.

Yoon Sun-young, a Hana Financial Research Institute researcher, emphasized the growing importance of virtual assets within investor portfolios. She noted that investors expect legal institutionalization and expanded roles for existing financial sector participants.

The study indicates that information sources are also evolving. Reliance on informal recommendations has declined, while official exchange platforms and analytical tools have gained prominence among Korean cryptocurrency investors.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.