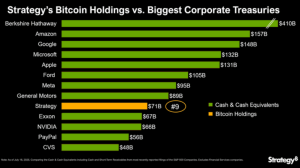

- Strategy broke into the top 10 US corporate treasuries and now ranks 9th with $71 billion in reserves.

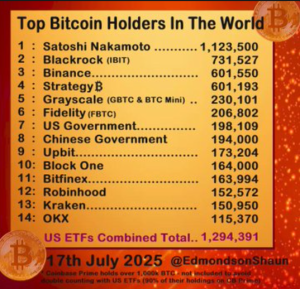

- The company holds 601,550 bitcoins and surpassed NVIDIA despite having a much smaller market cap.

- Bitcoin’s recent surge above $123,000 pushed Strategy ahead of traditional cash-holding corporations.

Strategy has achieved a historic milestone by entering the top 10 largest US corporate treasuries. The company now ranks 9th among S&P 500 companies, surpassing tech giant NVIDIA in treasury reserves despite NVIDIA’s $4.2 trillion market capitalization.

Strategy’s treasury portfolio stands at $71 billion, positioning it behind industry leaders including Berkshire Hathaway, Amazon, Google, Microsoft, Apple, Ford, Meta, and General Motors. The company’s unique approach sets it apart as the only major corporation holding Bitcoin as its primary reserve asset rather than traditional cash and cash equivalents.

Bitcoin Rally Drives Treasury Growth

The surge in rankings comes as Bitcoin reached new all-time highs above $123,000 in July 2025, generating substantial unrealized gains for Strategy’s holdings. The company currently holds 601,550 bitcoins with an average purchase price of $66,384.56 per bitcoin, representing a total investment of approximately $33.1 billion.

Strategy’s aggressive Bitcoin accumulation strategy began in August 2020 when CEO Michael Saylor made the unconventional decision to replace cash reserves with Bitcoin. Since then, the company has consistently expanded its holdings through strategic purchases funded by equity and debt offerings.

The volatility of Bitcoin presents both opportunities and risks for Strategy’s treasury ranking. As Bitcoin prices fluctuate, the company’s treasury value changes accordingly, potentially allowing it to climb higher among corporate treasuries or fall in rankings during market downturns.

Leading Position Among Bitcoin Treasury Companies

While Strategy ranks 9th among all US corporate treasuries, it maintains a commanding lead among Bitcoin treasury companies. The second-largest Bitcoin corporate holder, MARA Holdings, holds just 50,000 BTC compared to Strategy’s substantial position.

According to BitcoinTreasuries data, approximately 60 companies worldwide now hold Bitcoin in their corporate treasuries, highlighting the growing institutional adoption of cryptocurrency. Strategy’s influence has encouraged other corporations to consider Bitcoin a legitimate treasury asset.

The company’s stock (MSTR) has become the best-performing major asset since adopting Bitcoin, demonstrating how the treasury strategy has created shareholder value. Strategy operates under multiple ticker symbols, including MSTR, STRK, STRF, and STRD across different share classes.

Strategy’s position makes it the third-largest Bitcoin holder globally, trailing only Bitcoin’s anonymous creator, Satoshi Nakamoto (1.12 million BTC), and asset manager BlackRock (731,527 BTC). This ranking underscores the company’s significant influence in the Bitcoin ecosystem and corporate cryptocurrency adoption.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.