- Strategy bought 850 Bitcoin for $99.7 million and now holds 639,835 BTC worth $47.33 billion.

- MSTR stock dropped to a five-month low of $323 but remains up 14% for the year.

- Bitcoin trades below $113,000 amida broader crypto market decline caused by rising Treasury yields.

Strategy has announced its eighth consecutive weekly Bitcoin purchase, acquiring 850 BTC for $99.7 million despite ongoing declines in Bitcoin prices and the company’s stock value. The business intelligence firm paid an average of $117,344 per Bitcoin in this latest transaction.

The purchase brings Strategy’s total Bitcoin holdings to 639,835 BTC, valued at approximately $47.33 billion based on an average acquisition price of $73,971 per coin. The company reported achieving a 26% Bitcoin yield through its accumulation strategy.

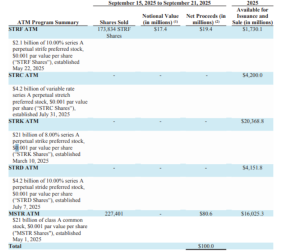

According to SEC filings, Strategy funded the purchase by selling company shares. The firm raised $80.6 million through MSTR stock sales and $19.4 million from STRF share sales. This financing method demonstrates the company’s commitment to expanding its Bitcoin treasury even during market downturns.

Source: Strategy’s SEC filing

Stock Performance Faces Headwinds

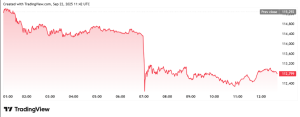

Strategy’s stock has experienced notable volatility amid its continued Bitcoin investments. MSTR shares currently trade around $336, representing a 2% decline from the previous week’s closing price of $344. The stock reached a five-month low of $323 per share recently, though it maintains a 14% gain year-to-date.

Source: TradingView; MSTR Daily Chart

The company’s stock performance has remained relatively flat over the past month, recording gains below 2%. This sideways movement contrasts sharply with earlier periods when Bitcoin rallies drove significant appreciation in MSTR shares.

Co-founder Michael Saylor hinted at the purchase through social media, posting that “The Orange Dots go up and to the right.” This statement reinforces the company’s long-term Bitcoin accumulation strategy and signals no intention to reduce holdings despite current market conditions.

Bitcoin Faces Broader Market Pressures

Bitcoin’s recent performance has contributed to the challenges that Strategy faces in its strategy. The cryptocurrency trades just below the $113,000 psychological level, down over 2% in the past 24 hours. This decline reflects broader cryptocurrency market weakness attributed to macroeconomic factors.

Source: TradingView; Bitcoin Daily Chart

Rising U.S. Treasury yields have created headwinds for digital assets, contributing to the current market downturn. Bitcoin critic Peter Schiff has predicted further declines, suggesting the cryptocurrency could fall below $100,000 while gold potentially rallies to $4,000.

Strategy’s latest purchase represents one of its smaller weekly acquisitions this year. The previous week’s purchase involved 525 BTC for $60 million, indicating the company continues its accumulation strategy regardless of purchase size variations.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.