- SWIFT is building a blockchain ledger with Consensys and over 30 banks for real-time cross-border payments.

- Institutions like JPMorgan, HSBC, and Bank of America will help develop and test the prototype.

- The ledger uses Consensys’ Linea network and will connect traditional banking systems to blockchain technology.

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) unveiled plans on Monday to develop a blockchain-based digital ledger in partnership with over 30 major financial institutions and ConsenSys, an Ethereum software company. The announcement came during the Sibos 2025 conference on September 29, marking a significant shift for the global banking infrastructure provider.

The initiative aims to transform cross-border payment systems by enabling real-time, 24/7 transactions through the use of distributed ledger technology. SWIFT CEO Javier Perez-Tasso stated the project would elevate the payments experience while maintaining the organization’s trusted platform as central to the industry’s digital evolution.

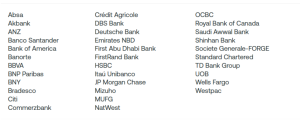

Global Banking Leaders Join Development Phase

JPMorgan, HSBC, and Bank of America are prominent institutions that are participating in the ledger’s development. These banks will contribute to the design of the prototype during Phase One and provide operational feedback throughout the project. Their involvement extends to implementing the initial system and shaping subsequent development phases.

Financial Institutions Assisting in Shared Blockchain Ledger

The collaboration seeks to expand access to regulated tokenized assets within traditional financial frameworks. SWIFT plans to deploy client solutions connecting various systems across private and public blockchain networks. This infrastructure will maintain security standards while facilitating interoperability between different digital platforms.

Consensys Selected for Technical Implementation

SWIFT chose Consensys to build the prototype infrastructure. The partnership will utilize the security, scalability, and resilience features of blockchain technology to support international transaction processing. The system will handle transaction recording, sequencing, and validation through automated smart contracts.

The global banking network selected Consensys’ Layer 2 network Linea over competing platforms for the pilot program. This decision supports SWIFT’s objective to move interbank messaging and communications onto blockchain rails. The selection demonstrates confidence in Ethereum-based infrastructure for large-scale financial operations.

The ledger will position SWIFT as an infrastructure provider for regulated tokenized value movement across digital ecosystems. The organization will not determine which tokens qualify for the platform. Central banks will retain authority over token eligibility and regulatory frameworks.

SWIFT has previously collaborated with Chainlink on multiple projects connecting traditional financial institutions to blockchain networks. These initiatives utilized existing infrastructure and messaging standards to bridge legacy systems with emerging technology. The experience gained from these partnerships informed the current ledger development strategy.

The blockchain ledger represents SWIFT’s response to growing demand for faster, more efficient cross-border payment solutions. Traditional international transfers often require multiple days for settlement. The proposed system could reduce transaction times to minutes while maintaining regulatory compliance and security protocols required by global banking standards.

Disclaimer

The content shared on KryptoVaultDaily is for informational purposes only and does not constitute financial or trading advice. We do not offer guarantees and assume no responsibility for investment decisions based on the material provided. Always research and seek guidance from a licensed financial advisor before trading cryptocurrency or investing.